Year-End Financial Reporting Checklist for HOA Managers

- June 9, 2025

- OHI

Year-end financial reporting is the cornerstone of successful HOA management. As fiscal periods draw to a close, HOA managers face the critical task of ensuring financial accuracy, regulatory compliance, and transparent reporting to stakeholders. This comprehensive checklist provides property managers with a strategic roadmap to navigate the complexities of year-end accounting while maintaining the highest standards of financial stewardship.

Bottom Line Up Front: Year-end financial reporting involves compiling, reconciling, and presenting all financial data to provide stakeholders with a clear picture of the HOA’s financial health, ensure regulatory compliance, and establish the foundation for the upcoming fiscal year.

The year-end financial reporting process encompasses multiple interconnected activities that require careful coordination and timing. Unlike monthly or quarterly reporting, year-end procedures demand exhaustive verification of all financial transactions, comprehensive reconciliation of accounts, and preparation of audited or reviewed financial statements that meet both legal requirements and stakeholder expectations.

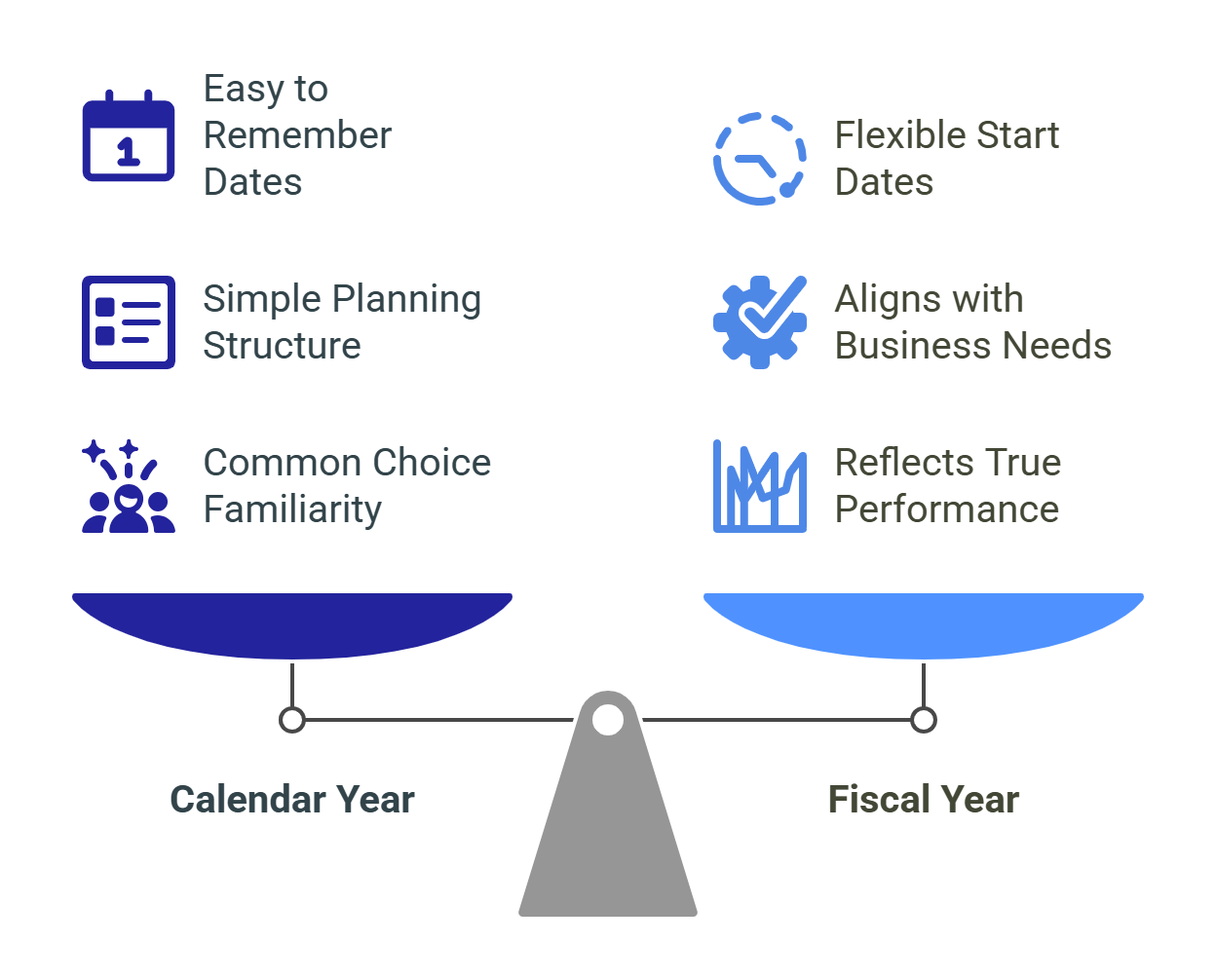

Many HOAs operate on a calendar year basis (January-December), while others choose fiscal years that align better with their operational cycles. Many HOAs in Denver, Lakewood, Aurora, and the surrounding areas have fiscal years that run from January to December, making December a particularly busy time for year-end activities. The choice of fiscal year impacts budget cycles, assessment collection patterns, and the timing of major capital projects.

Creating a detailed timeline is essential for managing the complex web of year-end activities. Starting in mid-August, we start providing our clients with a budget worksheet to begin the budget process. Typically, by mid-October, the budget is completed. Then in mid-November, the Board will ratify the budget. Your schedule should include:

Before initiating formal closing procedures, all pending financial matters must be resolved. On the payables side, this means making sure any outstanding invoices or vendor disputes are concluded and any variances are explained. On the receivables side, you will need to ensure all fines and fees are accounted for, delinquent assessments are submitted to collections, and bad debt is written off.

Bank reconciliation forms the bedrock of accurate financial reporting. This process involves:

Before running this report, one should also take into account uncleared payments and deposits, because the timing affects the results significantly. If there is a difference between the two, there may be embezzlement happening in your HOA, or some other issue that would be wise to catch sooner rather than later.

The year-end review of receivables and payables requires meticulous attention to aging and collection procedures:

Accounts Receivable Management:

Accounts Payable Review:

Proper fixed asset management is crucial for accurate financial reporting. GAAP requires that all tangible assets be recorded at their original cost at the time of acquisition (less any associated depreciation or amortization). This principle applies to both long-term and short-term assets.

Fixed Asset Review Process:

Depreciation on community structures, vehicles, or equipment also counts as a liability. Understanding this accounting treatment ensures proper balance sheet presentation.

The income statement serves as the primary tool for evaluating HOA financial performance. The Income Statement is otherwise known as the Profit-Loss Statement or the Statement of Income & Expense. It is the financial report that tallies the association’s profits and losses within an accounting period.

Key Components:

The Balance Sheet is a financial statement that shows the financial situation of the association, basically showing its net worth. This report takes into account the assets, liabilities, and equities to show the overall financial health of your HOA.

Balance Sheet Structure:

The cash flow statement tracks actual cash movements throughout the year, providing insights into liquidity management and operational efficiency. This statement categorizes cash flows into:

The law requires associations to prepare pro forma operating budgets that include all estimated expenses and revenues using the accrued basis method of accounting. Because the annual operating budget must be prepared using the accrual basis, the Income Statement should follow on the same basis.

Critical Accrual Adjustments:

Year-end requires careful review of prepaid expenses and deferred revenue items:

Year-end payroll and tax compliance requires coordination with multiple deadlines:

There are a number of required steps and deadlines you need to be aware of, such as when to file W-2s and W-3s, 1099s, and, of course, the actual tax return.

HOA tax obligations vary based on revenue levels and organizational structure:

Revenue Thresholds:

Reserve funds represent a critical component of HOA financial health. Year-end analysis should include:

The reserve study helps HOAs anticipate and prepare for future expenses. It includes: Component List: Identifying the major components the HOA is responsible for maintaining. Funding Plan: Strategies for funding the reserves to cover these anticipated expenses.

Year-end investment analysis ensures optimal reserve fund performance:

The general ledger serves as the foundation for all financial reporting. The general ledger contains the accounting record for each transaction in numerical order (chart of accounts) and occurrence (date order). This accounting tool gives your HOA manager detailed information tracking the financial transactions for the association.

Closing Process:

Year-end provides an opportunity to evaluate and strengthen financial controls:

Under Nevada law, there are five things the board must review every 100 days: One is a current year-to-date financial statement of the association, which is the revenue and expenses for the operating and reserve accounts. The next is the profit and loss statements for the operating and reserve accounts. The third is a reconciliation of the operating account, and the fourth is a current reconciliation of the reserve account.

Board Review Requirements:

Your HOA must send out its required annual disclosures before the fiscal year closes. This is the best way to avoid any penalties or suspicions that the association is not being managed above board.

Required Disclosures Include:

We highly recommend you engage a CPA who is well versed in community association financials to prepare your association’s tax return. Professional review ensures accuracy and compliance:

Service Level Selection:

Preparation Requirements:

You’ll get your draft financial reports typically on or a few days before January 31st. This is due to the additional time to wait for annual statements, review items, and ensure year-end numbers are accurate.

Quality Control Measures:

Year-end closing provides valuable insights for future improvements:

Performance Metrics:

Strategic Recommendations:

Successful year-end financial reporting requires meticulous planning, systematic execution, and attention to detail. By following this comprehensive checklist, HOA managers can ensure accurate financial reporting, maintain regulatory compliance, and provide stakeholders with the transparency they deserve.

The investment in thorough year-end procedures pays dividends through improved financial management, enhanced stakeholder confidence, and better positioning for future success. Remember that year-end closing is not just about completing required tasks—it’s about building a foundation for effective financial stewardship in the year ahead.

Key Success Factors:

By mastering these year-end financial reporting procedures, HOA managers can transform what might seem like a daunting annual obligation into a strategic opportunity for financial excellence and community trust.

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.