The Ultimate Guide to Capital Expenditure Planning for Real Estate Firms

- December 12, 2025

- Tajinder Malhotra

You just got a call from your property manager. The HVAC system at your main commercial property just gave up. The repair bill? $45,000—money you didn’t budget for.

This happens more often than you’d think.

Real estate owners and CFOs across the United States face this exact problem every single day. A roof decides to fail. An electrical system needs upgrading. Plumbing fails unexpectedly. Suddenly, that profitable property becomes a financial headache—something that could often be prevented with proper planning and reliable property accounting services.

The problem isn’t that these things happen. The problem is that most owners and CFOs don’t plan for them.

According to recent data, deferred maintenance costs real estate owners an average of 3-5 times more than preventive planning would cost. That’s not a typo. Emergency repairs run roughly three to five times higher than planned maintenance.

Here’s the truth: Capital Expenditure (CapEx) planning isn’t optional anymore. It’s the difference between a thriving real estate business and one that bleeds money on unexpected crisis repairs.

This guide walks you through exactly how to plan, budget, and execute capital expenditures so you stay ahead of problems instead of constantly reacting to them.

Capital expenditure sounds complicated. It’s not.

CapEx is simply money you spend to buy, build, upgrade, or significantly repair something that lasts more than one year.

Let’s use examples:

CapEx (these get capitalized):

OpEx (operating expenses—not CapEx):

The key difference: CapEx adds long-term value or extends the life of assets. OpEx keeps things running day-to-day.

Why does this matter? Because CapEx gets treated differently for taxes, accounting, and financial planning. And that’s where understanding it becomes money in your pocket.

Let’s talk about the real pain points.

The Owner’s Problem:

You bought properties thinking about rental income. You didn’t think about the fact that every building system has a lifespan. Roofs last 20 years. HVAC systems last 15-20 years. Plumbing has a finite life. Appliances wear out.

When you don’t plan for these replacements, they sneak up on you. Suddenly, you’re choosing between making payroll and fixing a critical system. That’s a nightmare no owner wants to face.

The CFO’s Problem:

CFOs get pressured from multiple angles. On one side, the board wants to see strong profits. On the other side, the properties need maintenance. And in the middle? Nobody has clear data about what’s actually needed, when, and how much it’ll cost.

Most companies haven’t created a formal CapEx schedule. They react instead of plan. This leads to inconsistent spending across years, missed tax deductions, inaccurate financial forecasts, board meetings full of surprises, and properties declining in value because maintenance was deferred.

Research from the real estate finance world shows that more than 40% of mid-sized real estate firms don’t have a structured CapEx planning process. That’s a massive blind spot.

The Shared Problem:

Both owners and CFOs struggle with the same core issue: nobody knows exactly what the properties need.

You might have a vague sense that the roof needs work in a few years. But do you have a formal inspection? A timeline? A cost estimate? Probably not. That uncertainty paralyzes decision-making.

When uncertainty rules, inaction wins. And deferred maintenance becomes a ticking time bomb.

Let’s put numbers to this problem.

Imagine you own a 100-unit multifamily building. The roof is 15 years old. A full replacement costs $150,000.

Scenario 1: You Plan Ahead

You inspect the roof. You get quotes. You budget $15,000 per year for the next 10 years. You replace it on schedule. Total cost: $150,000. You also get a tax deduction. You maintain property value. Tenants stay happy.

Scenario 2: You Ignore It

Year 10 rolls around. Nobody budgeted for it. The roof starts leaking. You keep patching it. Water damage spreads to internal walls. Mold issues emerge. Insurance premiums spike. Tenants leave. Property value drops 10-15%.

Now that $150,000 replacement has turned into:

Total damage: $600,000+. That’s four times the original cost.

This exact scenario plays out in real estate constantly. The owners and CFOs who plan ahead save money. The ones who don’t get crushed.

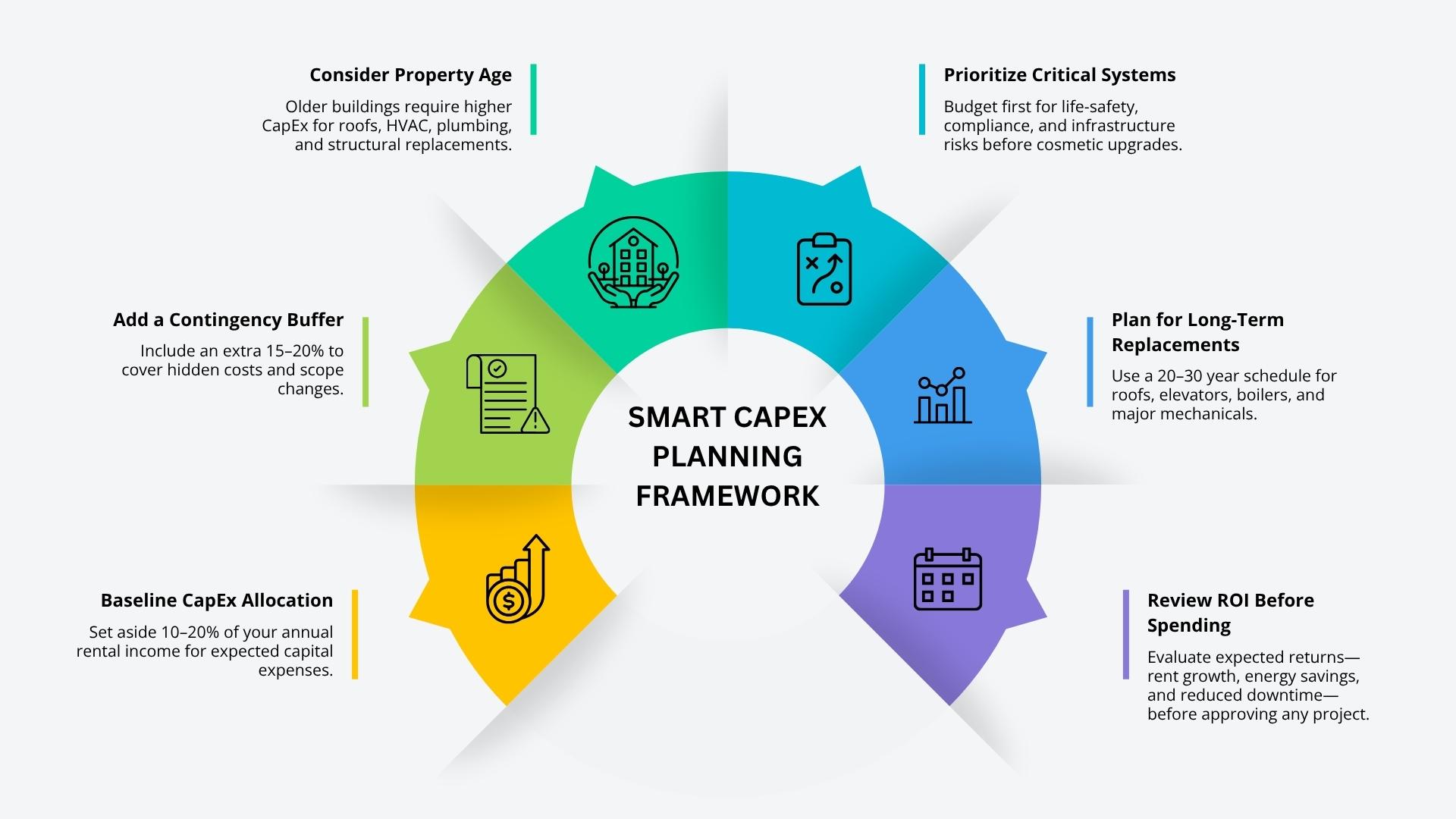

This is the question every owner and CFO asks. The answer depends on your situation, but there are proven benchmarks.

The most common approach in the US is to set aside 1-2% of your property’s purchase price annually for CapEx.

Example: You bought a property for $2 million. Set aside $20,000-$40,000 per year for CapEx. Some years you’ll spend less. Other years you’ll spend more. Over time, it averages out.

If you own multifamily or rental properties, another approach is 5-10% of your monthly rental income.

Example: Your 50-unit building generates $100,000 in monthly rental income. Budget $5,000-$10,000 per month for CapEx ($60,000-$120,000 annually).

This is more detailed. You estimate the lifespan of each major system and divide the replacement cost by remaining years.

Example: Your HVAC system costs $50,000 to replace. It lasts 20 years. Budget $2,500 per year to replace it in year 20.

Most successful owners and CFOs use a combination. They start with the percentage method as a baseline, then adjust based on property age, recent improvements, market conditions, and strategic goals.

The key is this: If you’re not budgeting 5-10% of gross revenue for CapEx annually, you’re probably underbudgeting.

You can’t plan for what you don’t know.

This is where most owners drop the ball. They assume properties are fine because there haven’t been major failures lately. That’s dangerous thinking. Just because a system hasn’t failed doesn’t mean it won’t tomorrow.

Get a professional inspection. Not a casual walkthrough. A real inspection from a qualified engineer or property specialist. They’ll document roof condition, HVAC performance, plumbing and electrical status, foundation integrity, parking lot condition, interior wear and tear, and compliance with current building codes.

Create a building condition report. This document becomes your baseline. It tells you exactly what your properties need, prioritized by urgency.

Do this every 2-3 years. Buildings don’t stay static. Systems age. New issues emerge. Regular assessments keep you informed.

Many owners skip this step because it costs $2,000-$5,000 per property. That’s a mistake. That cost is nothing compared to the emergency repairs you’ll face without that information.

Not all CapEx is created equal.

Here’s where owners and CFOs often make bad decisions. They see a list of needed repairs and freeze. The list feels overwhelming. So they either do nothing, or they make emotional choices instead of strategic ones.

The smart approach uses a priority matrix:

These aren’t optional. If a system creates safety risks or violates building codes, fix it immediately. Examples include faulty electrical systems, structural damage, code violations, and unsafe stairs or railings.

These protect you from liability and regulatory fines. Budget for these first, always.

These repairs directly impact your ability to collect rent and keep tenants. Examples include replacing failed HVAC, fixing plumbing in rental units, repainting to avoid tenant turnover, and replacing failed appliances.

These investments directly protect your revenue stream. If a tenant can’t heat their apartment, they leave. That vacancy costs you way more than the HVAC replacement.

These prevent long-term property decline and value loss. Examples include roof replacement before it fails, replacing HVAC before complete failure, updating electrical panels, and maintaining parking lots to prevent deep cracking.

These are preventive. They stop small problems from becoming big, expensive ones.

These increase property value or rental rates but aren’t essential. Examples include modern kitchen renovations, updating lobby design, adding new amenities, smart building technology, and sustainability upgrades.

These are nice to have, but they’re not urgent. Do these when cash flow allows, not instead of necessities.

The simple truth: Most owners and CFOs should spend 70-80% of their CapEx budget on priorities 1-3. Only spend on priority 4 after you’ve addressed the fundamentals.

Now comes the actual planning.

This is where most companies get vague. They say “we’ll budget for CapEx sometime” but never put actual numbers down.

Don’t do that.

Create a written CapEx schedule. List every major system in each property: roof, HVAC, plumbing systems, electrical systems, parking lots, exterior, interior, common areas, and appliances.

Estimate replacement cost. Get 2-3 quotes for each item. Don’t guess.

Estimate remaining lifespan. Your inspection report helps here. If the roof has 8 years left before failure, note it.

Divide remaining lifespan by years to spread costs. If the roof costs $150,000 and lasts 10 more years, budget $15,000 annually.

Create a rolling 10-year plan. Map out when each system needs replacement. Here’s what this looks like:

Year 1: Electrical panel upgrade ($40,000), paint common areas ($12,000) = $52,000 total

Year 2: Parking lot reseal ($25,000) = $25,000 total

Year 3: HVAC replacement ($80,000), plumbing updates ($20,000) = $100,000 total

Update annually. Every year, add a new year 11 to your plan. Adjust costs based on actual spending and new information.

This isn’t a one-time exercise. It’s an ongoing process. Most successful real estate companies now use software to manage this. Spreadsheets work, but software provides better visibility and automatically alerts you when projects are coming due.

You have choices about how to pay for capital projects.

Using your own money. Pro: You own it outright. Con: This ties up cash that could be invested elsewhere.

Set aside money monthly in a dedicated account. You save up for projects over time. Most property owners use this approach. It’s steady. It’s predictable. It works.

Borrow money for major projects. Can be attractive if interest rates are low and projects increase property value quickly. Pro: Preserves cash for operations. Con: You pay interest and carry debt.

Most successful CFOs use a combination. Small projects come from reserves. Large projects get financed if the numbers make sense.

The key decision: What’s your CapEx-to-capital-ratio? The real estate industry averages 5-10% of annual revenue for CapEx. But this varies by property type:

CFOs should track this ratio. If it’s too low, you’re deferring maintenance. If it’s too high, you might be over-improving.

The best CapEx plan isn’t worth much if you don’t manage it.

Actual vs. Budget: Did the roof replacement cost $150,000 like you estimated or $180,000? Track the difference.

Timeline adherence: Did the project finish on schedule? Delays often mean cost overruns.

Quality of work: Did the work hold up or do you have issues within a year?

Impact on property performance: Did the HVAC replacement lower energy costs? Did the renovation reduce vacancies?

Quarterly reviews work best. Every quarter, spend 30 minutes reviewing what CapEx was completed, whether costs were on budget, which projects are running over, and whether you need to adjust your projections.

This discipline catches problems early. A project 10% over budget in month two is fixable. A project 50% over budget discovered in month eight is a disaster.

For US-based CFOs and owners, here are the metrics to track:

In 2025, commercial real estate investment is expected to grow 10% to reach $437 billion. This reflects strong fundamentals, especially for prime assets.

Multifamily investment surged 39.5% year-over-year to $34.1 billion in Q2 2025, the strongest sector. This reflects continued demand for rental housing and opportunities in the space.

Cap rates (the return metric for CRE) range from 5-9% depending on property type and location. These relatively stable rates provide a framework for evaluating whether CapEx investments improve returns.

In a stable to growing market (like 2025), capital investments that maintain or improve properties make sense. If your property is delivering a 6% cap rate and you can invest in upgrades that increase rents 3%, that investment has strong ROI.

In declining markets, be more conservative. Focus on maintaining value rather than aggressive upgrading.

Most US commercial real estate investors target a 10-20% Internal Rate of Return (IRR) on investments, with cap rates between 6-9% for stable properties.

For CapEx projects specifically, owners should target at least a 10% return. If a $100,000 renovation doesn’t generate at least $10,000 annually in added rent or reduced costs, question whether it’s worth doing.

After years of watching property owners and CFOs navigate this, certain mistakes keep showing up.

| Mistake | What Happens | Fix / Recommended Action |

|---|---|---|

| Mistake 1: Underestimating Costs | You plan based on initial quotes but later discover hidden requirements like ducting or code compliance, raising the total cost. | Add 15–20% contingency, get multiple quotes, and account for unknowns. |

| Mistake 2: Ignoring Deferred Maintenance | Small issues (like minor roof wear) are ignored until they become major failures costing 3–4x more. | Prioritize preventive maintenance over emergency repairs—always cheaper. |

| Mistake 3: Mixing CapEx and OpEx | Misclassifying expenses results in IRS issues, compliance risks, and inaccurate financial reporting. | Understand IRS rules, maintain clear classification, consult a tax professional. |

| Mistake 4: No Written Plan | CapEx exists only in someone’s head. When leadership changes or when asked for forecasts, no one knows what’s needed. | Create a formal written CapEx plan, update annually, share with stakeholders. |

| Mistake 5: Failing to Prioritize | A long list of projects causes decision paralysis and leads to unexpected failures. | Use a priority matrix (Safety → Income Protection → Asset Preservation → Value Add). |

| Mistake 6: Not Tracking ROI on Projects | Money is spent on renovations without knowing if they improved occupancy, rents, or tenant retention. | Track ROI using rental rates, vacancy, energy savings, tenant retention metrics. |

Here’s where good CFOs stand out from average ones.

Average CFOs manage CapEx as a budget line item. Good CFOs connect CapEx to business strategy.

What is our strategic goal?

Growing the portfolio? Upgrade properties to attract better tenants and command higher rents.

Preparing for sale? Invest heavily in curb appeal and deferred maintenance fixes.

Reducing risk? Focus on critical systems and safety upgrades. Maximizing cash flow? Be selective. Only invest where ROI is clear.

What properties matter most? Flagship properties get priority. Marginal properties might only get essential maintenance.

What market conditions exist? In a hot market, aggressive upgrades make sense. You’ll capture returns quickly. In a slow market, be more conservative.

What’s our capital constraint? If capital is tight, prioritize projects with fastest ROI. If capital is abundant, you can take longer-term value-building projects.

When CFOs align CapEx spending with strategic goals, boards get it. Investors understand. Surprises disappear.

Let’s make this real.

| Section | Details |

|---|---|

| Portfolio Overview | 4 multifamily buildings, 200 total units, Midwest region |

| Initial Situation | No formal CapEx plan, aging assets, rising repair costs |

| Problems Faced | – Emergency HVAC failure ($40,000 borrowed at high interest) – Parking lot cracks spreading – Roof issues in Building 2 – High unit turnover due to outdated interiors – Cash bleed & negative tenant reviews – Stagnant property value |

| CapEx Needs Identified (10-Year Plan) | Total Required: $850,000 |

| Priority Breakdown | Year 1: HVAC + Roof Repairs – $180,000 Years 2–3: Parking Lot Reseal + Landscaping – $60,000 Years 3–5: Interior Renovations & Upgrades – $350,000 Years 6–10: System Replacements + Preventive Maintenance – $260,000 |

| Funding Strategy | – Cash reserves for Year 1 critical repairs ($180,000) – Monthly CapEx reserve build: $8,000/month – Capital improvement loan: $200,000 for renovations |

| Execution Process | – Quarterly budget vs. actual reviews – Adjusting estimates with real cost data – Monitoring project timelines – Measuring revenue & tenant impact |

| Results by Year 5 | – All critical repairs done on time & on budget – Vacancy improved from 8% → 4% (50% drop) – Rent increased by $50/unit/month = $120,000 more per year – Property valuation increased 18–22% – Huge savings from avoiding emergency repairs – Strong tenant satisfaction and reputation recovery |

| Bottom Line | Building a CapEx plan saved hundreds of thousands, boosted revenue, stabilized operations, and grew property value. |

Let’s come back to where we started.

That property manager calls about the $45,000 HVAC failure. For the owner who planned ahead, this isn’t a crisis. It was anticipated. Reserves were set aside. The equipment replacement fits into the budget.

For the owner who didn’t plan, it’s a financial emergency.

The difference between these two scenarios is simple: one person planned, the other didn’t.

Capital expenditure planning isn’t complicated. It’s not glamorous. It won’t get written about in real estate journals or impress your board with clever financial maneuvering.

But it will keep your properties valuable. It will protect your cash flow. It will prevent surprises from becoming catastrophes.

Most importantly, it separates the owners and CFOs who build real wealth from those who just survive month to month.

Your action right now:

Pick your largest property. Schedule an inspection. Get a professional assessment. Then spend two hours mapping out what that property needs over the next five years.

That’s it. That one action puts you ahead of 60% of property owners in America.

Do that, and you’re on your way to real capital expenditure planning.

Proactive CapEx planning isn’t just a financial exercise—it’s a safeguard against unexpected disruptions that can drain cash flow and damage property value. When owners and CFOs take the time to assess their buildings, prioritize critical needs, and build a multi-year plan, they move from reacting to crises to confidently managing long-term performance. A structured CapEx strategy protects assets, strengthens financial stability, and positions your portfolio for sustainable growth. Start small, stay consistent, and let disciplined planning become your competitive advantage.

Here’s money most owners leave on the table.

When you do proper CapEx planning, you also unlock tax benefits.

Depreciation deductions: Capital improvements can be depreciated over their useful life, reducing your taxable income. This is substantial on major projects.

Section 179 deductions: For certain property improvements under $1 million, you can deduct the full amount in the year of purchase (instead of depreciating over years). This requires proper documentation.

Cost segregation: For major renovations, specialized studies can accelerate depreciation deductions. Complex but valuable on large projects.

Energy tax credits: Certain green upgrades (solar, efficient HVAC, insulation) qualify for federal tax credits.

Proper classification matters: Understanding whether something is a repair (OpEx, immediately deductible) versus capital improvement (CapEx, depreciated) affects your tax position significantly.

Work with a CPA or tax specialist when planning major CapEx to ensure you capture all available deductions. The tax benefits alone often justify proper CapEx planning.

It prevents costly emergencies, protects asset value, stabilizes cash flow, and turns unexpected expenses into predictable investments.

Every 2–3 years. Regular inspections reveal system lifespans, compliance risks, and issues before they become expensive failures.

Use a mix of:

Follow a simple hierarchy:

Owners often use reserves, financing, or a hybrid approach. Large projects may justify financing if they support income or long-term value.

CapEx should align with your goals—growth, stabilization, pre-sale positioning, or maximizing cash flow—to guide smart investment decisions.

Yes, outsourcing brings expert forecasting, consistent inspections, and unbiased evaluations—saving time and reducing costly errors.

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.