Real Estate Accounting Efficiency: 2025 Benchmarks & 2026 Goals

- January 13, 2026

- Tajinder Malhotra

The real estate accounting landscape is shifting beneath our feet. As we navigate 2025, the industry faces a unique convergence of stabilizing interest rates, a wave of debt maturities, and a construction sector squeezed by costs. For C-suite leaders—CEOs, CFOs, and business owners—these macro trends aren’t just headlines; they are operational pressures that trickle down into every ledger and balance sheet.

In this environment, the efficiency of your real estate accounting function is no longer a back-office detail. It is a strategic lever. When 30% of maturing loans in office and retail sectors are at risk of needing restructuring, as noted in recent 2025 market observations, the speed and accuracy of your financial data can determine whether you seize an opportunity or miss a critical risk signal.

This guide breaks down where the real estate accounting industry stands today using fresh 2025 data. We will look at hard benchmarks for month-end closes and invoice processing, identifying what “good” looks like right now. More importantly, we will map out the objectives you should set for 2026 to transition your finance team from data processors to strategic partners.

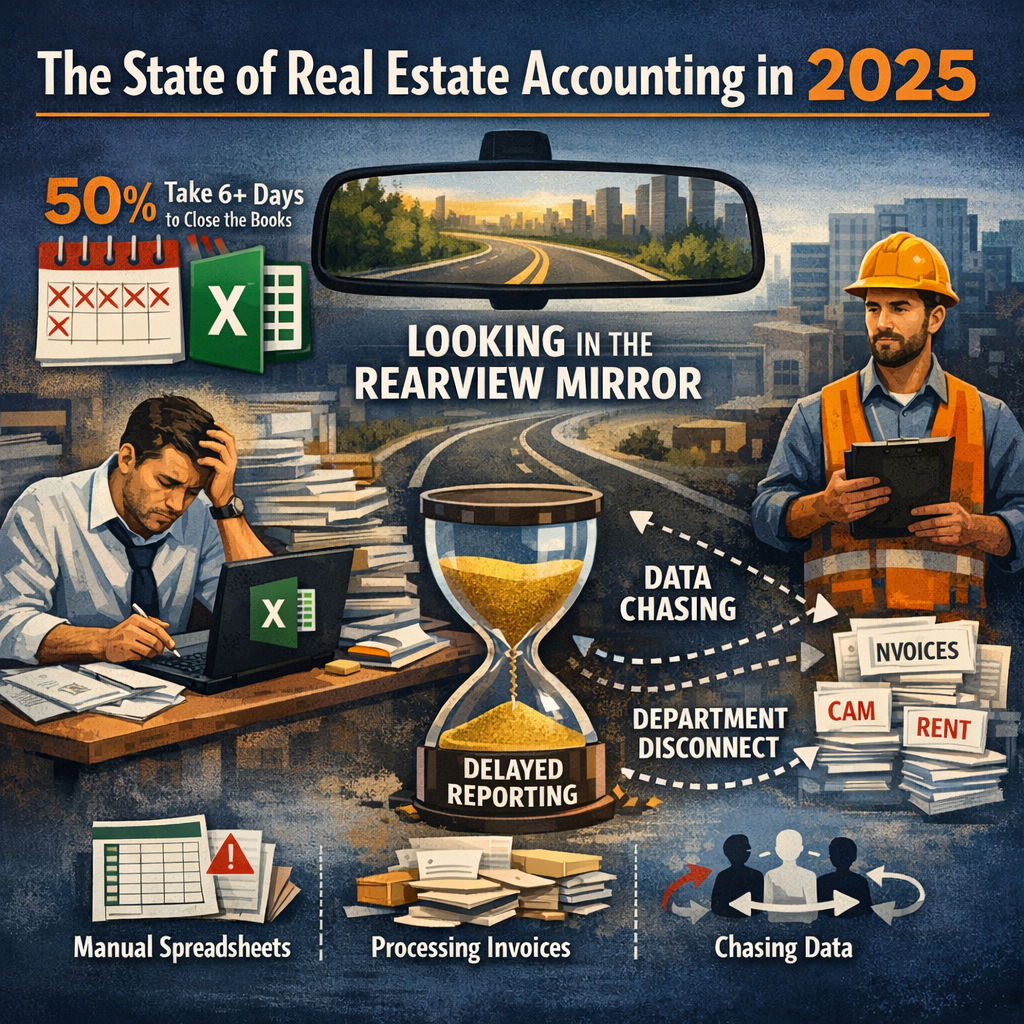

Before we look at where we are going, we must be honest about where we are. Despite the buzz around digital transformation, many real estate accounting teams are still shackled by manual processes.

According to 2025 survey data from Ledge, a staggering 50% of real estate accounting teams still take more than six business days to close the books. For a real estate firm managing multiple entities, properties, and portfolios, a week-long delay in financial reporting means you are driving the business while looking in the rearview mirror. By the time the numbers are finalized, the market has already moved.

The culprit is often a familiar foe: spreadsheets. The same data indicates that 94% of teams still rely on Excel for their month-end close, with half citing it as the primary reason for delays. While spreadsheets are flexible, they do not scale with transaction volume. In property management accounting, where rent rolls, CAM charges, and vendor invoices multiply exponentially with portfolio growth, Excel becomes a bottleneck rather than a tool.

Furthermore, dependencies on other departments create significant friction. Operations teams at the property level are often disconnected from the central finance function, leading to a game of “chase the data” that consumes valuable hours.

To set meaningful objectives for 2026, you first need to measure your current performance against industry standards. Here are the key operational benchmarks defining the landscape in 2025.

The “speed to close” is the pulse rate of your real estate accounting department. It indicates how quickly your team can validate data and produce reportable financial statements.

The Reality Check: If your team takes more than five days to close, you are statistically behind the curve. This delay compounds month over month, leaving your team in a perpetual state of catch-up.

Invoice processing is often the most labor-intensive part of real estate accounting. The difference between automated and manual shops is stark. According to 2025 research from Ardent Partners and Medius:

This gap of nearly two weeks impacts vendor relationships and cash flow visibility. In a sector where vendor reliability is crucial for property maintenance and tenant satisfaction, delaying payments by nearly three weeks is a competitive disadvantage.

Efficiency isn’t just about time; it’s about the bottom line. The cost to process a single invoice includes labor, systems, and overhead.

For a real estate accounting firm processing thousands of invoices a month across a portfolio, this variance represents hundreds of thousands of dollars in potential savings annually.

Reconciling bank statements against general ledgers remains a massive time sink.

If your controllers are spending a full work week every month just matching transactions across disparate bank accounts and property management systems, you are underutilizing their talent.

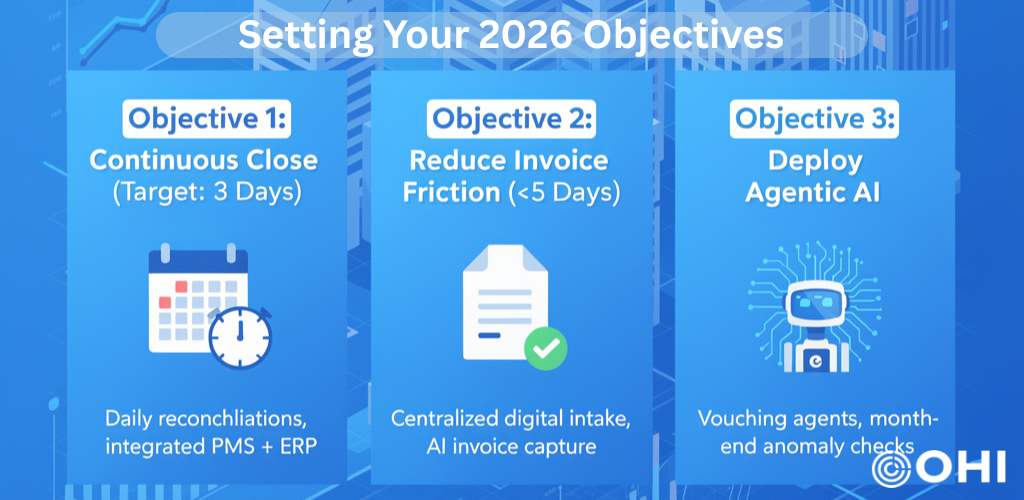

Benchmarks are useful, but action is better. Based on the data above, here are the three strategic objectives C-suite leaders should set for their real estate accounting functions for 2026.

The goal for 2026 should not just be a faster close, but a smoother one. The concept of a “continuous close” involves performing reconciliation tasks daily or weekly rather than waiting for the month to end.

Why this matters:

Real estate is capital intensive. You need real-time visibility into cash positions to make capital allocation decisions. Waiting until Day 10 of the following month to know your Net Operating Income (NOI) is a risk you cannot afford.

How to get there:

Your objective for 2026 should be to slash the time it takes to get an invoice from “received” to “ready for payment.”

Why this matters:

Construction and maintenance costs are rising. Vendors prioritize clients who pay on time. By accelerating AP, you not only reduce operational costs but also gain leverage to negotiate early-payment discounts—a direct boost to NOI.

How to get there:

2025 is the year of AI experimentation; 2026 must be the year of AI adoption. KPMG’s 2025 report highlights that 82% of leaders believe AI agents will be valued contributors. We are moving past simple chatbots to “Agentic AI”—digital workers that can perform autonomous tasks.

Why this matters:

Staffing shortages in real estate accounting are real. You likely cannot hire your way out of efficiency problems. AI agents can act as a force multiplier for your existing team.

How to get there:

If efficiency were easy, everyone would have achieved it by now. The Ledge 2025 report identified the top blockers preventing faster closes and smoother operations. Recognizing these in your own organization is the first step to dismantling them.

Finance teams often wait on property managers to approve invoices, confirm lease details, or explain variances.

We love Excel because it is flexible. We hate it because it is fragile. A broken formula or a version control error can cost hours of diagnosis.

Many real estate firms are running on on-premise servers or outdated software versions that don’t play nice with modern APIs.

| Area | 2025 Status | Notes |

|---|---|---|

| Software Adoption | Medium | Tools adopted but not fully integrated |

| Automation | Low | Mostly manual AP/AR & reconciliations |

| Reporting Speed | Medium-Low | Monthly reporting took time |

| Data Visibility | Low | Many teams worked on spreadsheets |

| Cost Efficiency | Medium | Some cost control, but overhead stayed high |

| Audit Prep | Medium | Still reactive, not structured |

| Investor Reporting | Medium | Higher demand than capacity |

| Talent Capacity | Low | Finance teams stretched |

| Compliance Tracking | Medium | More monitoring but slow processes |

| Category | 2025 Benchmark | 2026 Goal |

|---|---|---|

| Reporting Speed | Slow–Medium | Fast |

| Automation | Low | Medium–High |

| Software Use | Moderate | Integrated |

| Forecasting | Basic | Predictive |

| Data Visibility | Low | High |

| Audit Control | Reactive | Proactive |

| Cash Flow Insights | Limited | Continuous |

| Investor Reporting | Structured | Dynamic & Frequent |

| Cost Management | Passive | Strategic |

| Error Rates | High | Reduced |

| Talent Load | Heavy | Distributed |

| Operational Complexity | High | Optimized |

Operational efficiency often sounds like it is about replacing people with robots. For the C-suite, the narrative must be different. It is about elevating your people.

When you automate the data entry of an invoice, you don’t fire the accountant. You free them to analyze the data. You enable them to spot trends—like a specific property where utility costs are creeping up faster than the portfolio average.

In 2026, the ideal real estate accountant is a hybrid: part accountant, part data analyst. They need to understand how to prompt an AI agent, how to interpret a dashboard, and how to communicate financial insights to property managers. Investing in training your team on these tools is just as critical as paying for the software license.

To bridge the gap between 2025 benchmarks and 2026 objectives, start with these three actions this quarter:

The window to modernize is open, but it won’t stay open forever. As margins tighten and the market demands more agility, the operational efficiency of your real estate accounting function will become one of your most valuable assets.

2025 was a year of learning and experimentation.

Companies focused on basic efficiency improvements but faced barriers in automation and integration.

2026 will be about execution.

The goals are clear and the plans are more structured.

Real estate accounting must shift from manual and reactive processes to integrated and proactive ones.

Operational efficiency will continue to shape how real estate accounting firms manage portfolios, communicate with investors, and plan capital decisions. The firms that move faster on efficiency will outperform those that keep slow, manual, and fragmented processes.

Real estate accounting is the process of recording, tracking, and reporting financial transactions related to properties, such as rent, expenses, maintenance, taxes, and cash flow.

The 3-3-3 rule is a leasing guideline where tenants can stay 3 days without paying, get a 3-day notice, and then face eviction after 3 months if unresolved. It’s commonly referenced in rental compliance and property management discussions.

Real estate accounting can be complex because it involves multiple properties, entities, leases, CAM charges, reconciliations, vendor payments, and compliance rules. The complexity increases as portfolios grow.

The 5 P’s refer to Property, People, Promotion, Price, and Paperwork — a framework used for evaluating and managing real estate deals.

The four types are Residential, Commercial, Industrial, and Land.

Outsourced real estate accounting is when outside specialists manage bookkeeping and financial reporting for property firms to save cost and time.

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.