Addressing Liquidity Management in Portfolio Accounting

- March 5, 2024

- OHI

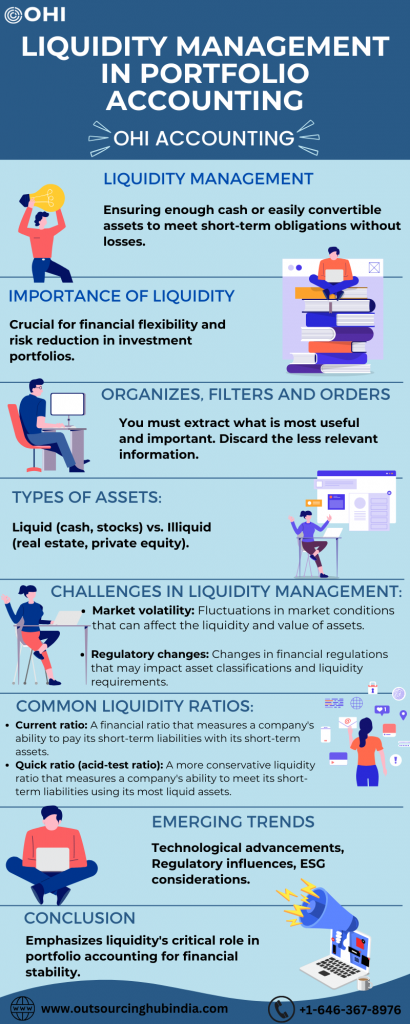

Liquidity management is all about making sure there’s enough money or things that can quickly be turned into money to pay for stuff when we need it. It’s like having enough coins in your piggy bank to buy candy at the store whenever you want. In the world of finance, liquidity management helps us keep track of how much cash or easy-to-sell stuff we have in our investment portfolios.

When we talk about liquidity management in portfolio accounting, we’re really talking about finding the right balance between having enough cash or things we can quickly sell, like stocks or bonds, and other kinds of investments that might take longer to turn into cash. It’s kind of like having both coins and bills in your piggy bank. You want to have enough coins for small purchases and some bills saved up for bigger expenses.

Having the right balance is super important because it means we’re prepared for any unexpected expenses without having to sell off our valuable investments at a loss. It’s like having a savings account for emergencies – we keep some money there just in case something unexpected comes up. So, understanding liquidity management helps us keep our investment portfolios healthy and ready for whatever comes our way.

Advances in technology offer sophisticated tools for liquidity management, from analytics that enhance cash flow forecasting to algorithms for early identification of liquidity risks. Real-time adjustment platforms facilitate swift portfolio modifications in response to changing liquidity scenarios, promoting more efficient and informed management practices.

Analyzing how certain portfolios navigated the 2008 financial crisis sheds light on effective liquidity management’s value. Those with robust liquidity strategies could better withstand market shocks, mitigating losses and, in some cases, seizing market opportunities that arose from the turmoil.

Emerging technologies, such as AI and blockchain, promise to further refine liquidity forecasting and management by offering deeper, actionable insights and more precise portfolio control. The investment landscape’s continuous evolution, along with regulatory shifts, will require adaptive and forward-thinking liquidity management strategies to meet the challenges and opportunities of the future successfully.

Understanding liquidity management in portfolio accounting is essential for maintaining financial health and readiness. By ensuring a balance between readily available cash or assets and longer-term investments, we can effectively meet financial obligations without compromising the value of our portfolios. Just like having a savings account for emergencies, liquidity management provides a safety net, allowing us to navigate unexpected expenses or market fluctuations with confidence.

In conclusion, mastering liquidity management empowers us to make informed decisions about our investments, safeguarding against liquidity risks and optimizing portfolio performance. It’s akin to having a well-stocked piggy bank – ready to cover everyday expenses while also having reserves for unforeseen circumstances. By embracing liquidity management principles, we can navigate the complexities of portfolio accounting with resilience and foresight, ensuring financial stability and flexibility for the future.

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.