QuickBooks for Property Management: Managing Multi-Entity Setups with Ease

- June 6, 2025

- Tajinder Malhotra

When property management involves juggling multiple entities, staying organized and efficient is key. Whether you’re managing several rental properties, working with investors, or overseeing a portfolio of commercial spaces, your accounting needs can get complex fast. This is where QuickBooks for Property Management can transform how you handle your finances.

This guide will provide valuable insights into managing multi-entity setups using QuickBooks, explain the software’s best features for property managers, and show you how to make the most of it. With real-life examples, detailed tips, and practical steps, you’ll be managing your property portfolio like a pro.

QuickBooks is one of the most trusted accounting platforms available, and for good reason. Its versatility, customizable features, and ease of use make it a top choice for property managers.

QuickBooks simplifies property management accounting so you can focus on growing your business.

When it comes to multi-entity setups, QuickBooks has specialized features that make life easier for property managers.

QuickBooks allows you to create separate budgets for each property, giving you better insight into individual performance. For instance, you can set aside specific amounts for maintenance, utilities, or marketing for each property.

| Feature | How It Helps |

|---|---|

| Budget by Location | Track income and expenses separately for each property. |

| Custom Chart of Accounts | Organize categories for easier tax preparation. |

| Owner Payments | Streamlined accounting for payouts to owners or stakeholders. |

QuickBooks helps property managers easily track rent payments, deposits, and other income sources through tools such as invoicing and payment management systems.

QuickBooks offers various reports that can give you a clear picture of your revenue, expenses, and overall financial health. Examples include profit and loss reports by property, cash flow statements, and physical occupancy rates.

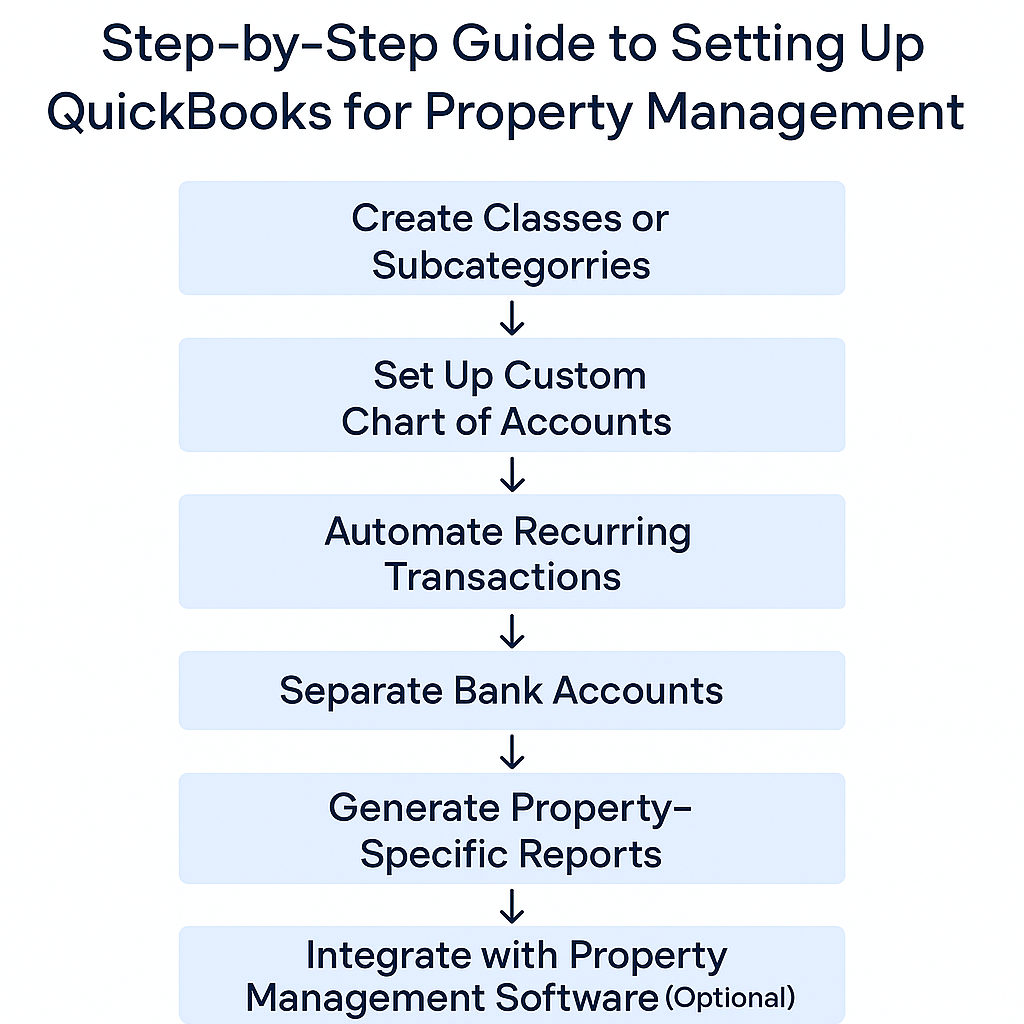

Use classes or tags to organize properties. This will allow you to track activity on a per-property basis. For example, create a class labeled “Downtown Apartments” or “Commercial Spaces.”

Make accounting easier by tailoring the chart of accounts for your property business. Some categories you should consider adding include:

Avoid spending unnecessary time on manual entries. Get QuickBooks to automate rent collection, tenant invoices, and utility bill payments.

Link separate bank accounts in QuickBooks for each property you manage. This ensures clear financial distinctions between entities.

Use QuickBooks’ customizable reporting tools to monitor each entity’s performance. For example, check whether Tenant A’s rental payment has been received or if the Downtown Complex requires additional maintenance expenditure. Reports can help you make data-driven decisions at a glance.

For an even smoother workflow, integrate tools like QuickBooks for Property Management software such as Buildium or AppFolio, giving you a single streamlined system for tenant management and accounting.

While QuickBooks for Property Management can be a powerful accounting tool for property managers, there are several important but often overlooked features and workflows that can significantly enhance its value for your real estate operations.

QuickBooks Online allows you to assign different access levels to users — such as accountants, property managers, or bookkeepers — ensuring that sensitive data is only available to the right people.

Why it matters: For teams managing multiple properties or owners, limiting access reduces errors and ensures financial data privacy.

Beyond tracking security deposits as liabilities, you’ll also need to:

QuickBooks doesn’t offer a built-in “deposit” module, but this can be managed by:

QuickBooks Online maintains an audit log that tracks:

Why it matters: For property managers handling funds for others, this feature provides transparency during owner reviews or audits.

QuickBooks doesn’t have native owner-statement generation, but with customization:

Tip: Export to Excel or PDF and format with headers for professional presentation.

While QuickBooks can record rent payments, it doesn’t include built-in rent collection. Integrate tools like:

Why it matters: This enables automated payment collection, late fee tracking, and faster reconciliation.

If you sell a property or asset, you’ll need to:

QuickBooks can:

If managing HOAs, you’ll also need:

Setup Tips:

The QuickBooks for Property Management mobile app allows managers to:

Why it matters: Property managers who are always on-site can keep accounting up to date without returning to the office.

QuickBooks for Property Management doesn’t have a built-in lease calendar, but you can:

Alternative: Use property management software that integrates directly with QuickBooks.

QuickBooks for Property Management is great for financial accounting, but not built for tenant communications, maintenance ticketing, or lease tracking. Here’s how it stacks up:

| Feature | QuickBooks | AppFolio/Buildium |

|---|---|---|

| Accounting | ✅ Strong | ✅ Strong |

| Tenant Communication | ❌ Manual | ✅ Built-in |

| Maintenance Tracking | ❌ Spreadsheet workaround | ✅ Ticketing system |

| Owner Portal | ❌ Manual | ✅ Automated |

| Rent Collection | ✅ With add-ons | ✅ Integrated |

| Custom Reporting | ✅ With setup | ✅ Pre-built |

| Cost | 💲 Lower | 💲💲 Higher |

Tip: Use QuickBooks for Property Management + integration tools (e.g., Zapier, Leasecake, Buildium API) to close the functionality gap.

QuickBooks for Property Management has a range of add-ons that make property management even more efficient. Add payroll tools to handle employee or contractor wages, or tax add-ons to optimize deductions.

Ensure your financial records are accurate by reconciling each linked bank account monthly.

| Best Practices | Why It’s Important |

|---|---|

| Reconcile bank accounts | Prevents oversights or errors in financial data. |

| Schedule quarterly audits | Identifies inconsistencies before tax season. |

Property managers can integrate QuickBooks for Property Management with tax preparation tools like TurboTax to simplify tax reporting and deductions for individual properties.

QuickBooks for Property Management, though not built specifically for property management, can be a highly effective tool when set up correctly. With features like class tracking, custom charts of accounts, and integration options, it helps manage multiple properties, track finances, and streamline operations.

By addressing its limitations with smart workarounds and add-ons, QuickBooks for Property Management offers clear financial visibility and improved efficiency—making it a reliable choice for property managers handling anything from a few units to large portfolios.

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.