Real Estate Accounting in 2025: A Strategic Guide for Professionals

- August 15, 2025

- Arvind Panwar

If you are a real estate agent, property manager, or someone who owns and invests in properties, you probably know that handling money and keeping track of your finances is a big part of your job. Real estate accounting might sound scary or complicated, but it doesn’t have to be. With the right steps and a little bit of learning, you can make real estate accounting simple and use it to help your business grow.

In this guide, we’ll break down everything you need to know about real estate accounting in 2025. We’ll use simple words, real-life examples, and easy tips so you can understand and use this information right away. Let’s get started!

Let’s start with the basics. Real estate accounting is simply the way you keep track of all the money that comes in and goes out of your real estate business. This includes things like:

Think of real estate accounting as your business’s money diary. It helps you see where your money is coming from, where it’s going, and how much you have left. This is important because it helps you make smart choices, avoid mistakes, and grow your business.

You might wonder, “Why do I need to care about accounting? Can’t I just focus on selling houses or renting out properties?” Here are some reasons why real estate accounting is super important:

Now that you know why accounting is important, let’s talk about what you actually need to keep track of. Here are the main things:

You might hear the words bookkeeping and accounting and wonder if they mean the same thing. They are related, but not exactly the same.

Bookkeeping is about recording every transaction—every time you earn or spend money. It’s the first step.

Accounting is about looking at those records, making sense of them, and using them to make decisions. Accountants also prepare reports and help with taxes.

Think of bookkeeping as writing down every ingredient you use in a recipe, while accounting is looking at the recipe and deciding how to make it better.

| Bookkeeping | Accounting |

| Recording every transaction | Analyzing and making sense of those records |

| Writing down income and expenses | Preparing reports and tax returns |

| Keeping receipts and invoices | Giving advice and helping with decisions |

Bookkeeping is the first step; accounting is the next level.

Some people use these terms as if they mean the same thing, but there are differences. Here’s a simple comparison:

| Feature | Real Estate Accounting | Property Accounting |

| Focus | Entire real estate business (sales, rentals, etc.) | Individual properties or portfolios |

| Tracks | Commissions, sales, business expenses, taxes | Rent, repairs, tenant deposits, property expenses |

| Users | Agents, brokers, real estate firms | Property managers, landlords, investors |

| Reports | Profit & loss, business tax, cash flow | Rent roll, maintenance logs, property performance |

| Purpose | Understand overall business health | Manage and analyze each property’s performance |

In short:

Here are some simple tips to help you do your real estate accounting the right way:

1. Keep Personal and Business Money Separate

Always use a separate bank account for your real estate business. Don’t mix your personal money with your business money. This small step makes it much easier to see how your business is doing.

2. Use Accounting Software

Many easy-to-use programs are built just for real estate. QuickBooks, FreshBooks, and DoorLoop are a few favorites. These tools let you:

3. Review Your Finances Every Month

Set aside half an hour each month to look over your books. Are you spending too much? Are sales what you expected? A quick check now lets you fix trouble before it gets big.

4. Save All Your Receipts

Hang onto every receipt and invoice for money you earn or spend. Toss them in a file, scan them, or snap a quick picture with an app. Keeping proof makes tax time easier and protects you later.

5. Know Your Tax Write-Offs

Many everyday costs can shrink your tax bill when you list them as deductions. Common write-offs include:

Check with your accountant to get a full picture of what passes and what doesn’t.

6. Back Up Your Records

Whether your files sit on a laptop or desktop, a backup is smart. Save copies to cloud storage and an external drive so you stay covered if the hardware fails.

Even seasoned agents slip up from time to time. Here are frequent hiccups and the quick fixes:

1. Mixing Personal and Business Money

This error is huge. Open a separate bank account and use a dedicated credit card for your business.

2. Skipping Solid Record-Keeping

Missed receipts can cost you deductions or lead to tax mistakes. Write down every deal, sale, and expense.

3. Overlooking Depreciation

Own a property? You can deduct a piece of its value each year as it “ages.” Remember to record that depreciation.

4. Not Reconciling Your Accounts

Reconciling your accounts each month means matching your own records with your bank statement so nothing gets missed. Doing this regularly helps catch mistakes, fraud, or forgotten fees early.

5. Doing Everything Yourself

When phone calls, paperwork, and showings pile up, it may be time to bring in a bookkeeper or accountant who knows real estate and can keep your numbers neat.

You can handle basic receipts and invoices, but a real estate accountant becomes valuable as your business expands. Here s how they lighten the load:

A skilled accountant can save hours of worry and even pay for their own fee with the money they find.

Hundreds of programs claim to track money, yet few fit the quirks of real estate. When choosing, watch for these must-have features:

Pick a tool that saves frustrations today and makes tomorrow s taxes less scary.

Top picks for 2025 still include DoorLoop, QuickBooks Online, and FreshBooks, each with features that suit different sizes of firms.

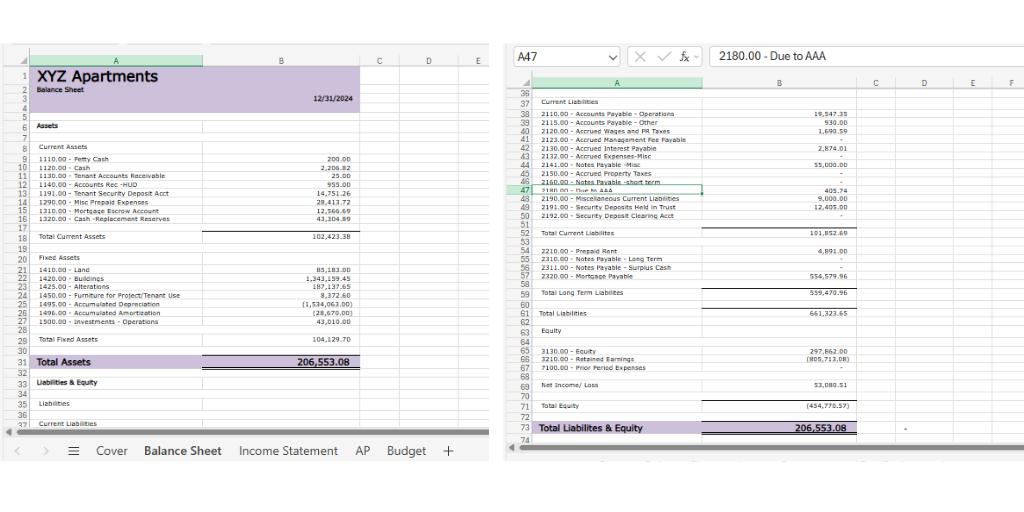

In real estate accounting, having clear, organized financial statements is key to understanding your business’s financial health and making smart decisions. A residential real estate financial statement summarizes your property’s income, expenses, assets, and liabilities in one place—giving you a straightforward picture of how your investments are performing.

A typical statement will include:

To help you visualize this, we’ve included a sample residential real estate financial statement PDF. This example demonstrates how to organize your financial data clearly and effectively, making it easier to keep your books accurate and your business decisions informed.

The world of real estate never stops moving, and neither does its bookkeeping. Here are three big trends shaping the way you count dollars in 2025:

If your business is brand-new and you close only a few deals a year, DIY books may work for you. But watch for these red flags that point toward a pro:

Paying an expert feels like another expense, yet it can spare you far bigger bills later.

Real estate accounting may look like a mountain of forms and numbers, but at its core its just knowing where your money goes and using that truth to steer your business. Start small: jot down every rent check, scan every invoice, lean on apps that sort the mess for you, and call in a pro when the math gets hairy. Whether you own a single condo or fifty townhouses good numbers will spot opportunities, shield you from audits, and ultimately help your portfolio flourish.

And you dont have to carry that load by yourself. Affordable software, local CPAs, and even online freelancers stand ready to lighten the work. Grab the reins of your accounting in 2025, keep the books tidy, and watch your real estate ventures grow.

Q: Is real estate accounting hard?

At first, yes, but apps and steady practice lighten the load. Start small, read up, and call a mentor when you stall.

Q: How much can I save by outsourcing real estate accounting?

Outsourcing can save you 40–60% annually compared to hiring in-house, by reducing salary, benefits, and overhead costs.

Q: What’s the Difference Between Bookkeeping and Accounting?

Bookkeeping is basically the steady hand that logs every dollar in and out. Accounting takes those logs, adds some bigger-picture thinking, and turns them into reports that guide your next moves.

Q: What Are the Main Duties of a Real Estate Accountant?

A real estate accountant monitors rental income, tracks repairs and utility bills, preps quarterly tax estimates, produces property performance reports, and makes sure every number sits square with local laws.

If you have questions about real estate accounting or want to share your own tips, leave a comment below!

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.