From Chaos to Clarity: Organizing Finances with Accounts Payable Outsourcing

- April 5, 2024

- OHI

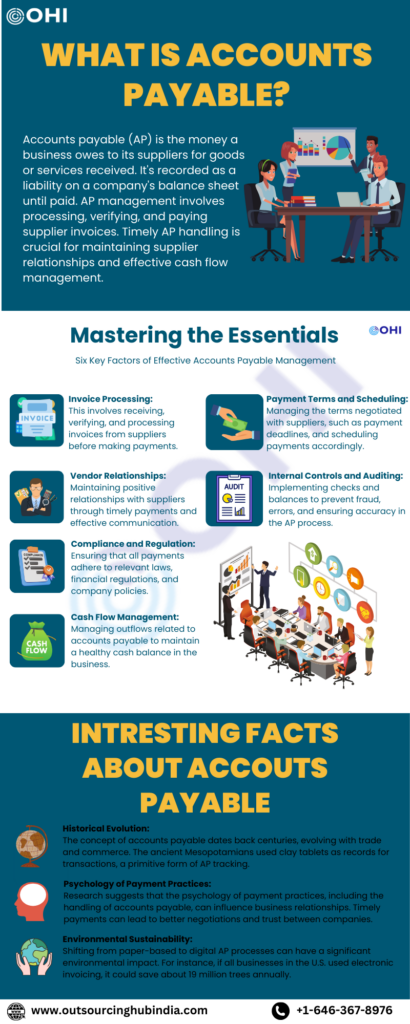

In the fast-paced business world, financial clarity and efficiency are crucial for success, and nowhere is this more evident than in the management of accounts payable (AP). AP, encompassing everything from invoice processing to managing debts owed to suppliers, is a complex but vital part of a company’s financial health. For many businesses, particularly small to medium-sized ones, handling these tasks can be overwhelming, often resembling a chaotic juggling act of numbers, deadlines, and paperwork.

Enter accounts payable outsourcing – a strategic solution that transforms this chaos into streamlined efficiency. By delegating the intricate tasks of AP management to specialized providers, businesses not only achieve accuracy and compliance but also free up internal resources to focus on core activities. Outsourcing AP is more than a tactical decision; it’s a strategic move towards enhancing a company’s overall financial operation and competitive edge in a market where efficiency is key.

Managing accounts payable is a critical aspect of a company’s financial health, involving the tracking and processing of payments owed to vendors and suppliers. The challenges in this process are particularly acute for small and medium-sized enterprises (SMEs). These challenges encompass several areas:

Outsourcing accounts payable transforms these challenges into a streamlined process by utilizing the expertise of specialized service providers:

Improved Efficiency and Time Management

Enhanced Accuracy and Reduced Errors

Cost Savings

Better Cash Flow Management

Enhanced Security and Fraud Prevention

Compliance and Regulatory Adherence

Transitioning to an outsourced accounts payable model requires careful consideration and planning:

Choosing the Right Service Provider

Clear Communication of Needs and Expectations

Integration and Training

Continuous Monitoring and Feedback

The transition from managing accounts payable in-house to outsourcing is akin to stepping out of a fog of complexity into a realm of streamlined efficiency and clarity. It’s a transformative journey that reshapes not only the accounts payable process but also the broader financial management landscape of a business. By entrusting this vital function to experts, companies unlock the potential to redirect their focus and resources towards growth and innovation. Outsourcing brings with it not just a delegation of tasks, but an infusion of expertise, technology, and best practices that can revitalize a company’s financial operations. It’s a strategic move that goes beyond mere cost savings; it’s about fostering a more robust, agile, and forward-thinking financial ecosystem within the organization.

Moreover, the benefits of outsourcing accounts payable ripple out to affect various facets of the business. Improved efficiency and accuracy in financial transactions lead to stronger relationships with vendors and suppliers, enhanced reputation, and the ability to negotiate better terms. The cost savings realized can be reallocated to fund strategic initiatives, propelling the company towards achieving its long-term goals. In essence, outsourcing accounts payable is not just a solution to a problem; it’s an opportunity to elevate a business’s financial health and operational excellence. As the business landscape evolves and becomes increasingly competitive, the clarity, efficiency, and strategic edge provided by accounts payable outsourcing become not just beneficial but essential for businesses aiming to thrive in the modern market.

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.