Mastering HOA Accounting: A Practical Playbook for Smarter Board Decisions

- July 30, 2025

- OHI

It’s more than police work and landscaping to be a homeowner’s association (HOA) manager. Perhaps the most crucial—and most complex—responsibility of HOA board members is handling the finances of the association. Whether your HOA is in-house run or contracts the services of an HOA accounting company, understanding what HOA accounting the key is to have a financially healthy, transparent, and compliant community.

This article is for HOA and condo board members who want a quick, realistic grasp of HOA accounting and how to do it right.

HOAs are not profit businesses, but they have revenue, expenses, assets, and liabilities just like a business. Therefore, formal accounting rules must apply.

Inefficient money management in an HOA can lead to cash shortages, delayed maintenance, surprise special assessments, and even lawsuits. On the other hand, good accounting preserves property values, achieves homeowner trust, and ensures long-term capital needs are met.

“When an HOA’s books are accurate, the whole community benefits—homeowners feel secure, and the board can plan wisely.”

In essence, accounting for HOAs involves monitoring all finances—what’s coming in, what’s going out, and where the money’s going. Unlike a typical business, though, HOAs come with the additional challenge of balancing operating expenses and long-term capital planning through two primary funds: the Operating Fund and the Reserve Fund.

The Operating Fund covers routine expenses like landscaping, utilities, and security. The Reserve Fund is the savings account that covers unusual, big-ticket expenses—like replacing a roof, modernizing an elevator, or painting buildings.

The two-fund approach adds a bit of complexity to HOA accounting over normal property accounting, especially when there are condo associations, where common amenities create needs for maintenance.

To accurately report on HOA finances, several statements are issued each month and annually. They help the board monitor finances, prepare for audits, and provide information to homeowners.

This statement reports your community’s overall financial situation—its assets, liabilities, and equity (or net worth). It always balances as the following:

Assets = Liabilities + Equity

The balance sheet shows the amount of cash in hand, the amount due to vendors, and the amount of equity (usually in reserve account) available.

Also called the Profit & Loss statement, it shows how much money the HOA has brought in compared to how much was spent over a given time frame. It provides the indication whether the association is operating its budget or not.

It is the HOA’s general ledger, where everything is posted. All transactions—a homeowner’s special assessment payment, a vendor invoice—are posted here. It’s the source of all the other reports.

These reports say what the HOA is owed and what others owe the HOA. Regular tracking of these is necessary so that vendors can be paid in a timely manner and homeowners are up to date on their assessments.

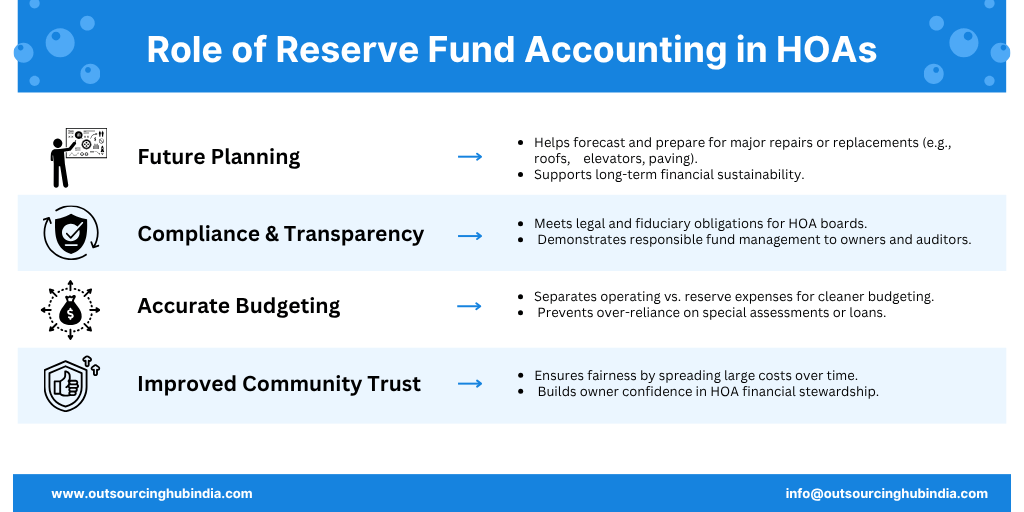

Of perhaps the most important element of HOA financial planning is having a well-operating reserve fund. This is a pot of capital to cover major repair bills or unforeseen costs not included in day-to-day business.

Examples of the ways a reserve fund might be used include:

Reserve Fund Information:

“Reserve funds are the financial seatbelt of an HOA. You hope you never need them—but when you do, they protect the community from financial whiplash.”

Understanding the differences between HOA accounting methods is easier with a side-by-side view. Use the table below to compare the three common methods:

| Accounting Method | Cash Basis | Accrual Basis | Modified Accrual |

|---|---|---|---|

| Record Income | When received | When earned | When earned |

| Record Expenses | When paid | When incurred | When paid |

| Accuracy Level | Low | High | Medium |

| GAAP Compliant | ❌ No | ✅ Yes | ❌ Partial |

Even well-intentioned HOAs can make accounting missteps that lead to financial instability or legal trouble. Recognizing and avoiding these errors is key to maintaining transparency and homeowner trust.

1. Misclassifying Reserve and Operating Expenses

Many HOAs fail to properly separate day-to-day operating costs from long-term capital expenses. This can result in depleted reserve funds and underfunded future projects.

Poor recordkeeping—missing invoices, untracked approvals, or undocumented board decisions—can lead to audit issues, legal risk, and homeowner distrust.

HOAs that rely on outdated budgets often overlook inflation, rising vendor costs, or new maintenance needs. A current, line-item budget helps ensure financial health.

Ignoring or delaying follow-up on delinquent homeowner dues creates cash flow problems and unfair burdens on compliant residents. Have a clear collections policy in place.

Without monthly bank reconciliations, errors or fraud may go unnoticed. Reconciling ensures all records match and discrepancies are addressed early.

The Generally Accepted Accounting Principles (GAAP) provide the principles for preparing accurate and comparable books of accounts. Keeping away from GAAP is not only good practice—it also protects the board from possible liability legally and enhances the confidence of homeowners.

Being GAAP-compliant also places your HOA in a position to pass professional audits or examinations, typically required by state law or governing documents.

The following is the way board members and managers can do it right when it comes to financial management:

| Best Accounting Practice | Description |

|---|---|

| 1. Enact Internal Controls | Separate key financial duties (e.g., writing vs. cashing checks) and require dual authorization for major purchases to reduce fraud risk. |

| 2. Use Specific Chart of Accounts | Avoid vague categories like “Miscellaneous Expenses.” Use precise labels such as “Pool Repairs” or “Legal Fees.” |

| 3. Reconcile Accounts Periodically | Reconcile bank statements with the general ledger monthly to detect and fix errors early. |

| 4. Budget Carefully | Create a detailed annual budget that includes both routine expenses and long-term capital projects. Use historical data and vendor quotes. |

| 5. Proactively Manage Delinquencies | Address overdue payments early and transparently to maintain cash flow and fairness. |

| 6. Conduct Yearly Audits or Reviews | Hire a CPA for annual financial reviews or audits to ensure transparency and detect potential issues. |

HOA accounting is crucial for managing the financial health of homeowners associations, involving various methods, financial statements, and responsibilities for board members.

Homeowners associations (HOAs) function similarly to businesses, managing revenue and expenses to maintain community standards. Proper accounting practices are essential to ensure financial stability, transparency, and compliance with legal requirements. Poor financial management can lead to significant issues, including insufficient funds and potential legal action against board members for mismanagement.

There are three primary accounting methods used by HOAs:

HOAs must prepare various financial statements to monitor their financial status, including:

Board members have a fiduciary duty to manage the association’s finances responsibly. This includes:

To streamline accounting processes, many HOAs utilize specialized accounting software. Popular options include TOPS Software, Caliber Software, and Village Management Software (VMS), which help manage finances efficiently and reduce the burden on board members.

In summary, effective HOA accounting is vital for the sustainability and success of community associations. By understanding accounting methods, preparing accurate financial statements, and fulfilling their responsibilities, board members can ensure their HOA remains financially healthy and transparent.

Condo associations also possess analogous accounting responsibilities to regular HOAs but with more complexity. As owners often share pipes, roofs, elevators, and walls, then maintenance and replacement are costly.

This, thus, makes cost allocation and reserve studies even more critical. Condo boards must also deal with longer-term insurance, metering utilities, and shared asset appraisals, so professional HOA accounting services are even more critical.

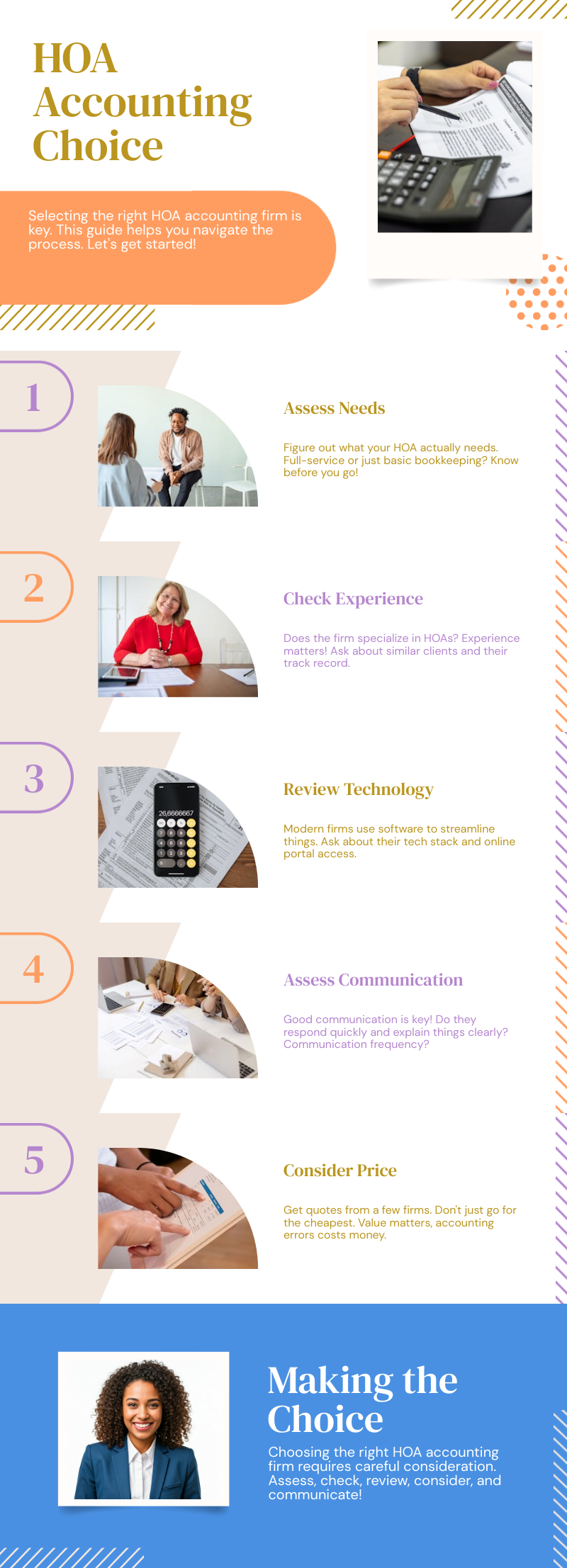

Not every community has the expertise or means to do accounting in-house. Hiring a professional HOA accounting firm can:

Ensure to hire a firm that is:

“Outsourcing HOA accounting is not sacrificing control—it’s acquiring expertise”

While HOAs are largely nonprofit organizations, they do have to file tax returns annually. Two of the most used forms are:

HOAs will need to hire a tax consultant to decide which form to use depending on their income and expenses.

New HOA accounting software makes most of the tasks such as invoicing, budgeting, and financial reporting easier. Such programs can:

Technology optimizes efficiency and keeps the board structured, particularly for self-managed associations.

Managing HOA finances isn’t just about crunching numbers—it’s about following consistent and clear workflows that ensure accuracy, compliance, and transparency. To help board members and HOA accountants streamline their processes, we’ve created a detailed HOA Month-End Accounting Checklist that covers all essential tasks across.

Sound financial practices are the secret to a successful homeowners or condo association. As a potential board member or seasoned treasurer, being able to manage money, prepare reports, and be compliant will be an asset to your community.

Healthy HOA accounting isn’t just about numbers—it’s about trust-building, surprise-avoiding, and keeping your community looking its best for years to come.

If your board is having trouble keeping your finances in the black, it might be time to join forces with a trustworthy HOA accounting firm or bring in professional HOA accounting services. With experts and the right software, your board can focus on what it does best: serving your community.

The accrual basis of accounting is generally considered the best method for HOAs. It records income when earned and expenses when incurred, providing a more accurate and complete picture of the association’s financial health. It is also GAAP-compliant and recommended by most accounting professionals and auditors.

HOAs should follow Generally Accepted Accounting Principles (GAAP) to ensure transparency, accuracy, and legal compliance. Core principles include:

The Profit & Loss Statement (P&L)—also called the Income Statement—is a key financial report showing how much income the HOA has earned and how much it has spent over a specific time period. It helps board members understand whether the association is operating within its budget and if any financial adjustments are needed.

In accounting, HOA stands for Homeowners Association—a nonprofit organization responsible for managing a residential community’s common areas and amenities. HOA accounting involves tracking revenues (like member dues) and expenses (like maintenance or insurance) while ensuring compliance with financial regulations and long-term capital planning.

The primary purpose of a Homeowners Association (HOA) is to maintain and manage common property within a residential community, enforce community rules (CC&Rs), and ensure a consistent standard of living for residents. Financially, the HOA is responsible for collecting dues, managing budgets, funding reserves, and handling repairs and improvements for shared spaces.

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.