How Property Management Software and Accounting Services Support Different Real Estate Needs

- November 6, 2025

- Arvind Panwar

Property owners, managers, and financial professionals face a critical decision that can make or break their operations: should they invest in property management software or outsource to specialized property accounting services? This choice affects everything from daily workflows to long-term profitability, yet many professionals struggle to understand which option truly serves their needs.

The stakes are higher than you might think. Poor financial management in real estate can lead to audit failures, compliance issues, and missed opportunities for cost savings. Meanwhile, the right solution can streamline operations, improve tenant satisfaction, and boost your bottom line significantly.

This comprehensive guide will help you understand the fundamental differences between property management software and property accounting services, examine the unique needs of different stakeholders, and make an informed decision that aligns with your business goals and resources.

Property management software serves as a digital hub for real estate operations, combining various functions into one integrated platform. These systems typically handle rent collection, maintenance requests, tenant screening, lease management, and basic financial reporting.

Modern property management platforms offer cloud-based accessibility, mobile apps for property managers, and tenant portals for self-service options. They automate routine tasks like rent reminders, late fee calculations, and maintenance scheduling, which can save significant administrative time.

| Feature | Description |

|---|---|

| Automated Rent Collection & Payment Processing | Streamlines rent payments, late fees, and recurring billing automatically. |

| Maintenance Request Tracking & Vendor Management | Tracks work orders, schedules repairs, and manages vendor assignments efficiently. |

| Tenant Screening & Application Processing | Screens applicants, verifies backgrounds, and manages digital applications. |

| Lease Administration & Document Storage | Organizes lease agreements, renewals, and important documents in a secure system. |

| Basic Financial Reporting & Accounting Integration | Generates reports on income, expenses, and integrates with accounting systems for tracking. |

| Communication Tools for Tenants & Property Managers | Facilitates notifications, messages, and tenant portal access for seamless communication. |

The appeal lies in having everything under one roof. Property managers can track maintenance issues while simultaneously monitoring rent collections and generating basic financial reports. This integration reduces the need to switch between multiple systems and minimizes data entry errors.

However, the financial capabilities of most property management software remain relatively basic. While they can handle standard transactions and generate simple reports, they often fall short when it comes to complex property accounting requirements, tax planning, or sophisticated financial analysis.

Property accounting services specialize exclusively in the financial aspects of real estate management. These services are provided by accounting firms or specialists who understand the unique challenges and requirements of real estate accounting.

Unlike general accounting services, property accountants focus specifically on real estate regulations, tax implications, and industry-specific financial practices. They handle everything from daily bookkeeping to complex financial analysis and strategic planning.

| Service | Description |

|---|---|

| Comprehensive Bookkeeping & Transaction Recording | Tracks all financial transactions, ensuring accurate and up-to-date records. |

| Monthly, Quarterly, & Annual Financial Statements | Prepares detailed reports, including income statements, balance sheets, and cash flow statements. |

| Tax Preparation & Planning Specific to Real Estate | Handles tax filings, identifies deductions, and implements strategies for tax efficiency. |

| Audit Preparation & Support | Ensures all records are organized and compliant for internal or external audits. |

| Cash Flow Analysis & Forecasting | Monitors inflows and outflows, predicts trends, and ensures liquidity for operations. |

| Investment Performance Tracking & ROI Analysis | Evaluates property profitability, investor returns, and performance metrics. |

| Compliance Monitoring for Industry Regulations | Ensures adherence to real estate laws, accounting standards, and reporting requirements. |

| Strategic Financial Consulting & Planning | Provides actionable insights for budgeting, capital planning, and long-term growth strategies. |

The primary advantage of working with property accountants is their deep expertise in real estate accounting principles. They understand depreciation schedules, cost segregation studies, 1031 exchanges, and other complex real estate financial concepts that general accounting software cannot handle effectively.

Property accounting services also provide the human element that software lacks. When you face unusual transactions, regulatory changes, or strategic decisions, you can consult with experienced professionals who understand your specific situation and industry challenges.

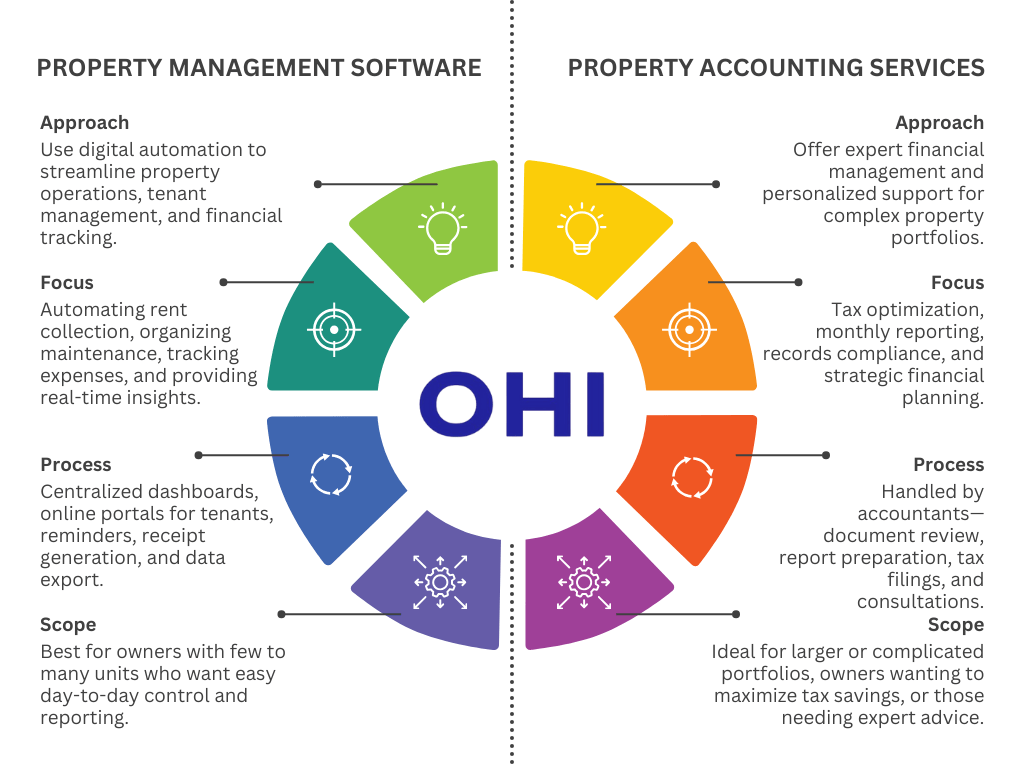

The fundamental difference between property management software and property accounting services lies in their scope and depth of financial expertise.

Property management software takes a broad approach, covering operational aspects like tenant management, maintenance coordination, and basic financial tracking. The software excels at automating routine tasks and providing a centralized platform for daily operations.

Property accounting services focus exclusively on financial management, offering deep expertise in real estate accounting principles, tax optimization, and financial strategy. They provide human expertise and customized solutions that software cannot replicate.

Software typically involves monthly or annual subscription fees, with costs ranging from $1-10+ per unit per month depending on features and provider. The predictable pricing structure appeals to budget-conscious property managers.

Professional accounting services usually charge based on the complexity and volume of work, often ranging from a few hundred to several thousand dollars monthly depending on portfolio size and service level. While potentially more expensive, the cost often reflects significant value in tax savings and financial optimization.

Customization and Flexibility

Software solutions offer standardized features that work for most properties but may lack flexibility for unique situations. Customization options are often limited to configuration settings rather than fundamental functionality changes.

Professional services provide highly customized solutions tailored to specific property types, ownership structures, and financial goals. Accountants can adapt their approach based on changing regulations, market conditions, or business objectives.

Property owners and CEOs face unique challenges that significantly impact their decision between software and services. Hidden costs represent a major concern, as unexpected expenses can quickly erode profitability. Many owners struggle with unclear return on investment calculations, making it difficult to evaluate property performance accurately.

Scalability doubts plague growing portfolios, as systems that work for five properties may fail at fifty. Market trend uncertainty adds another layer of complexity, requiring sophisticated analysis to make informed acquisition and disposition decisions.

Capital expenditure planning demands expertise in depreciation schedules, cost segregation, and tax implications that basic software cannot provide. Tenant retention and acquisition costs require careful tracking and analysis to optimize profitability.

For owners and CEOs, property accounting services often provide better ROI clarity through detailed financial analysis and strategic planning. Professional accountants can identify tax-saving opportunities and provide insights that justify their cost through improved financial performance.

Property managers deal with operational challenges that directly impact their daily efficiency and tenant satisfaction. Time-consuming processes like RFP creation, manual workflows, and lack of automation create bottlenecks that reduce productivity.

Tenant communication and conflict resolution require significant attention, while maintenance and repair coordination demands efficient tracking and vendor management systems. Lease administration and enforcement involve complex legal and financial considerations.

Property managers often benefit more from comprehensive software solutions that streamline operations and automate routine tasks. However, they still need reliable financial support for complex accounting situations and regulatory compliance.

Financial executives face the highest stakes when it comes to property accounting decisions. Audit risks can result in significant costs and regulatory issues, while manual reconciliation processes increase error probability and consume valuable time.

Compliance exposure represents a serious concern, as real estate regulations continue evolving and penalties for non-compliance can be severe. Cash flow management requires sophisticated forecasting and analysis capabilities.

Financial reporting accuracy and timeliness are critical for decision-making and investor relations. Budget variance analysis helps identify problems early, while investment analysis and performance tracking guide strategic decisions.

For controllers and CFOs, professional property accounting services often provide essential expertise and risk mitigation that software alone cannot deliver. The cost of compliance failures or missed tax opportunities typically far exceeds the investment in professional services.

Choosing between property management software and property accounting services requires careful consideration of your specific circumstances, resources, and objectives.

Software solutions work best for smaller portfolios with straightforward financial requirements. If your properties involve standard residential or commercial leases without complex ownership structures, software can provide adequate financial tracking while streamlining operations.

Organizations with limited budgets may find software more accessible initially, though they should consider long-term costs and potential limitations. Properties with high tenant turnover may benefit from software’s automated communication and processing capabilities.

Larger portfolios with diverse property types typically require professional accounting expertise. Complex ownership structures, multiple investor groups, or sophisticated financing arrangements demand specialized knowledge that software cannot provide.

Properties subject to specific regulatory requirements, such as affordable housing or commercial properties with complex lease structures, benefit from professional guidance. Organizations focused on tax optimization and strategic financial planning find significant value in professional services.

Many successful property management companies combine both software and professional services to leverage the benefits of each approach. Property management software handles operational tasks and basic financial tracking, while professional accountants provide expertise for complex financial matters.

This hybrid approach allows organizations to maintain operational efficiency while ensuring financial accuracy and compliance. The key is finding software that integrates well with your accountant’s systems and processes.

Some property accounting services offer their own software platforms or partner with established property management systems to provide seamless integration. This approach combines operational efficiency with professional expertise.

Making the right choice between property management software, professional accounting services, or a hybrid approach requires a clear understanding of return on investment and awareness of emerging trends in real estate accounting operations.

A simple ROI comparison helps property owners and managers evaluate the impact of each approach on time, cost, and risk:

| Approach | Time Savings | Cost Implications | Risk Reduction | Key Benefits |

|---|---|---|---|---|

| Software-Only | Moderate: Automates routine tasks like rent collection, maintenance scheduling, and tenant communication | Lower upfront costs; subscription fees per unit | Limited: Basic financial tracking; compliance and tax errors possible | Operational efficiency, centralized management, tenant satisfaction |

| Services-Only | Minimal on operational tasks; relies on manual workflows | Higher monthly or per-property fees | High: Expert oversight reduces audit failures, compliance issues, and accounting errors | Deep financial expertise, accurate reporting, strategic financial planning |

| Hybrid (Software + Services) | High: Automation reduces manual tasks while accountants handle complex financials | Moderate-to-high depending on software and service package | Very high: Combines operational efficiency with professional financial oversight | Best of both worlds: streamlined operations, accurate finances, compliance assurance, strategic insights |

Insight: For mid-to-large property portfolios, the hybrid model often provides the best ROI—balancing efficiency, cost control, and financial accuracy. It allows owners to save time, reduce errors, and make informed, strategic decisions.

The real estate industry is evolving rapidly, with technology and professional services driving efficiency and smarter financial management:

Key Takeaway: By combining technology trends with professional accounting expertise, property owners and managers can streamline operations, improve financial visibility, and scale portfolios efficiently. Leveraging both tools strategically ensures you stay competitive in a fast-moving real estate market.

The choice between property management software and property accounting services ultimately depends on your specific situation, resources, and objectives. Software excels at operational efficiency and basic financial tracking, while professional services provide expertise and strategic guidance that technology cannot replicate.

Consider your portfolio size, complexity, and growth plans when making this decision. Evaluate your team’s expertise and available time for financial management tasks. Most importantly, calculate the total cost of ownership, including hidden costs of errors, missed opportunities, and compliance failures.

The most successful property management operations often combine both approaches strategically, using software for operational efficiency and professional services for complex financial matters. This hybrid approach provides operational streamlining while ensuring financial accuracy and strategic guidance.

Start by honestly assessing your current challenges and future goals. If you’re struggling with basic operations and tenant management, property management software might provide immediate relief. If financial reporting, tax planning, or compliance concerns keep you awake at night, professional property accounting services could deliver significant value and peace of mind.

Q1. What is property accounting?

Property accounting is specialized real estate accounting that tracks income, expenses, taxes, and ROI for properties. It ensures accurate reporting for owners, managers, and investors and is a key part of professional property accounting services.

Q2. Is property management software the same as property accounting?

No. Property management software handles tenants, leases, rent, and maintenance, while property accounting focuses on financial reporting, compliance, tax planning, and cash flow analysis.

Q3. Do I need property accounting services if I already use software?

Yes. For multiple properties, investors, or audit needs, property accounting services provide expertise in real estate accounting, financial reporting, and strategic planning beyond what software offers.

Q4. Which is better: property management software or property accounting services?

It depends. Software is cost-effective for operational tasks, while property accounting services deliver advanced financial accuracy, compliance, and tax optimization.

Q5. Can I use both property management software and property accounting services together?

Absolutely. Software automates day-to-day tasks, while accounting services ensure accurate financial reporting, compliance, and ROI analysis—a hybrid approach provides maximum efficiency.

Q6. Are property accounting services only for commercial real estate?

Mostly yes, due to complex leases and tax rules. Large residential portfolios can also benefit from professional property accounting services and real estate accounting expertise.

Q7. How much do property accounting services cost?

Costs vary by portfolio size and complexity, generally ranging from a few hundred to several thousand dollars per month. The investment is often offset by tax savings and improved financial insights.

Q8. What are the benefits of property management software?

It automates rent collection, lease management, tenant communication, and basic financial tracking while integrating with accounting systems for better reporting.

Q9. How do property accounting services improve ROI?

They optimize taxes, track cash flow, forecast investments, and prevent compliance mistakes, helping owners and managers make informed financial decisions.

Q10. Can small landlords rely on software alone?

Yes, for 1–5 units with simple leases. Larger or more complex portfolios benefit from professional property accounting services for accuracy, compliance, and optimized ROI.

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.