How HOA Asset Managers Can Drive Efficiency Through Accounting Outsourcing

- November 14, 2025

- Amit K. Vatsayan

When you manage a homeowners association, accounting isn’t just about numbers on a spreadsheet. It’s the backbone of your community’s financial health. Yet most HOA managers still rely on outdated systems, manual processes, and scattered documents. The result? Delayed decisions, missed opportunities, and a team that’s drowning in administrative work instead of focusing on what matters.

This is where accounting outsourcing changes everything.

By outsourcing your HOA accounting functions, you unlock real visibility into your assets, make faster decisions, and protect your community from costly errors. Let’s explore how professional accounting services can transform your HOA operations.

Running an HOA without automation feels like managing a portfolio with your eyes closed. Your team is processing invoices manually, reconciling bank statements with spreadsheets, tracking dues in fragmented systems, and spending hours generating reports that board members need yesterday.

According to industry research, up to 73% of homeowners now expect real-time access to financial data. Your board members likely have similar expectations. Yet when accounting is manual, delivering that transparency becomes nearly impossible.

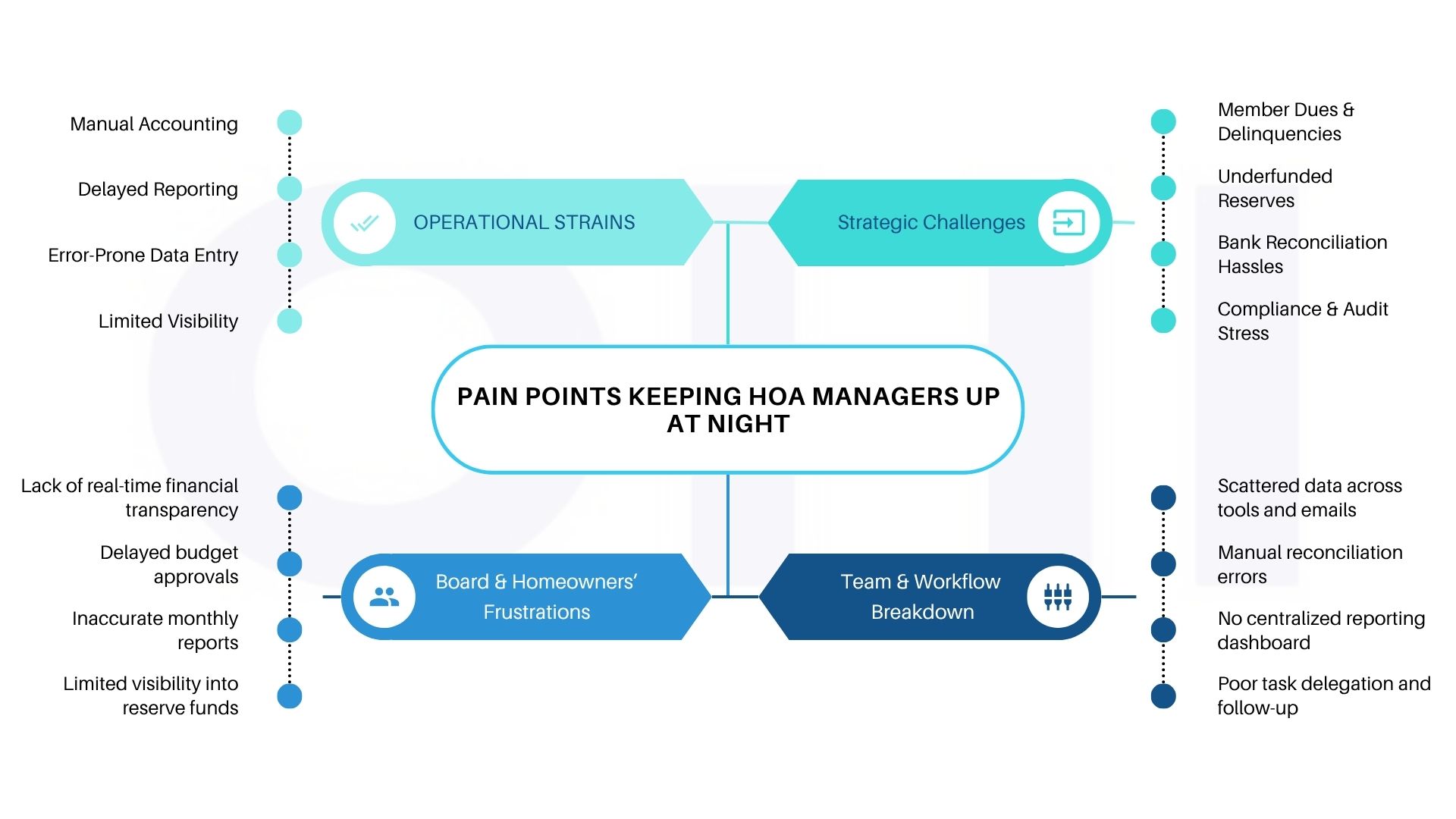

Here’s what typically happens in associations without proper accounting systems:

1. Multiple Data Silos

Financial information gets scattered across different platforms—spreadsheets, outdated software, email attachments, and paper files. A board member asks about a specific expense, and you’re scrambling through three different systems to find the answer.

2. Delayed Reporting

Month-end closes take forever. Instead of having financial reports ready by the 10th, your team is still reconciling accounts on the 25th. This lag means boards make decisions based on incomplete or outdated information.

3. Human Error in Data Entry

When you’re manually entering transactions, mistakes happen. Duplicate entries, misclassifications, and typos create discrepancies that take days to track down. One study found that 60% of HOAs struggle with account reconciliation issues, leading to inaccurate financial reporting.

4. Limited Asset-Level Visibility

You know how much you’re spending overall, but do you know which assets are generating the most expenses? Which properties need attention? Which reserve funds are being used effectively? Without integration between your accounting and asset management, this data remains hidden.

The consequence? Your board lacks the visibility needed to make informed decisions about capital improvements, reserve allocation, and operational changes.

Let’s get specific about the challenges. These are the real struggles managers face every day:

Dues are your lifeblood. When collection processes are manual, you’re tracking payments across multiple systems. Some payments come through online portals, others by check, and still others need follow-ups. Delinquencies pile up, and by the time you realize payment is overdue, the problem has compounded.

The Impact: According to community association research, manual dues collection creates cash flow issues, delays in paying vendors, and difficulty in forecasting budget needs.

Up to 60% of HOAs are underfunded in their reserves. This isn’t always due to poor planning—it’s often because financial data is so disorganized that reserve needs get overlooked or misjudged.

The Impact: Unexpected expenses trigger special assessments that anger homeowners. Your association’s reputation suffers, and your board faces criticism.

Reconciling accounts with bank statements using spreadsheets is a recipe for headaches. Double data entry, missed deposits, unapproved transactions, and duplicate entries pile up. You’re essentially doing the same work multiple times.

The Impact: Reconciliation errors lead to inaccurate financial statements. Worse, they mask potential fraud and increase audit risk.

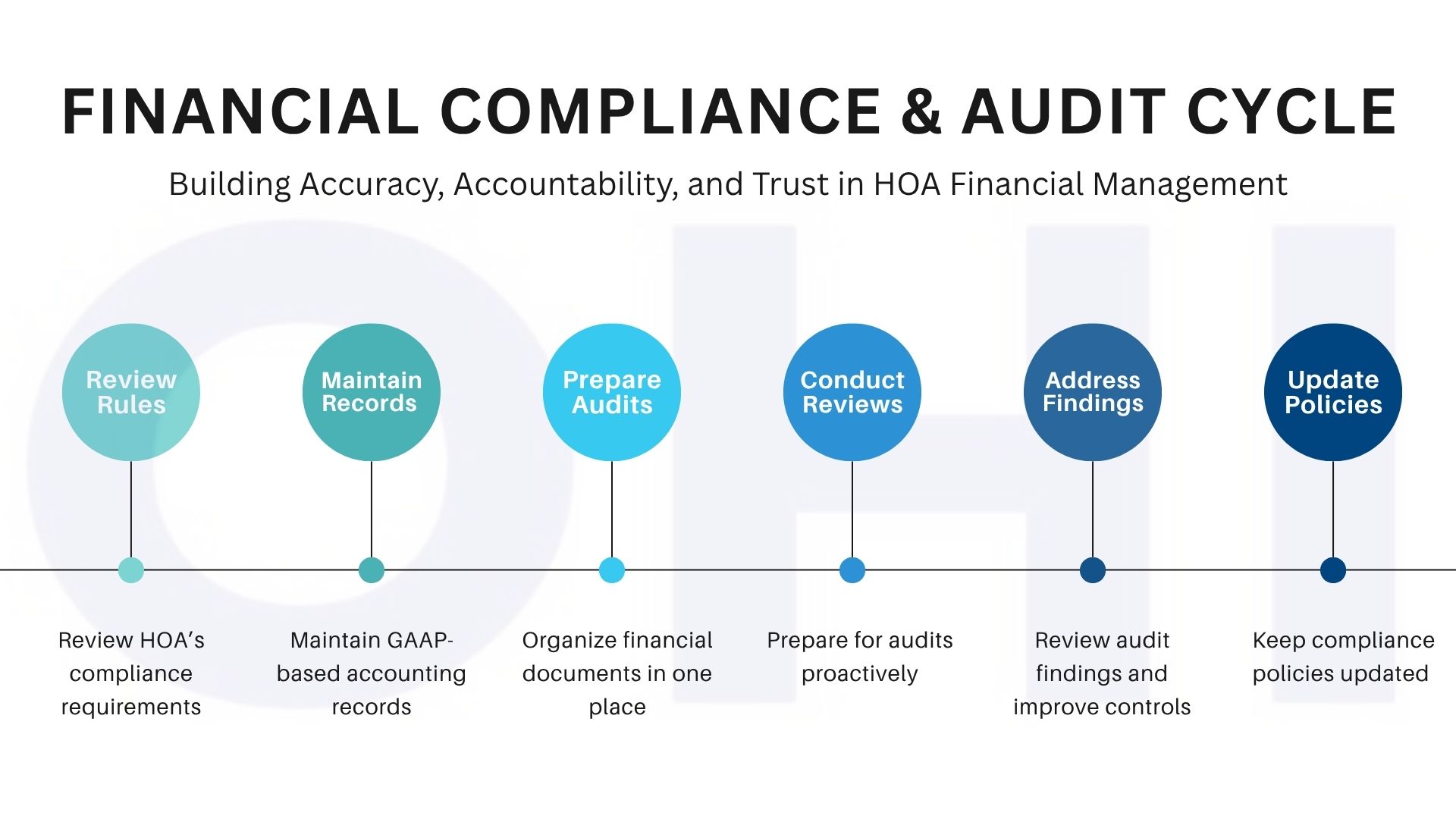

HOA regulations vary by state, but most require regular audits and specific financial reporting standards. Many associations must follow accrual-basis accounting (recording revenues when earned and expenses when incurred, not just when cash changes hands). Preparing for audits with manual processes is time-consuming and error-prone.

The Impact: Missed compliance deadlines result in fines. Inaccurate records lead to audit findings that damage your association’s credibility.

Your board needs comprehensive financial reports to make smart decisions. But when accounting is fragmented, you can’t quickly answer questions like “What did we spend on maintenance last year compared to this year?” or “Which properties are underperforming?”

The Impact: Boards make decisions without complete information. Asset investments don’t get prioritized correctly. Opportunities for cost savings are missed.

Before diving into solutions, let’s understand exactly how manual processes limit you:

Visibility Loss Across Your Portfolio

When accounting data isn’t centralized, you lack a single source of truth. Financial information lives in different places, and nobody has a complete picture of portfolio performance. This fragmentation prevents asset-level decision-making.

Delayed Decision-Making

With manual processes, generating a simple report takes days. Your board meetings happen on the 15th of the month, but your financial data isn’t ready until the 20th. By then, decisions have already been made with incomplete information.

Time Wasted on Non-Strategic Work

Your team should be analyzing financial trends and identifying opportunities. Instead, they’re manually entering data, reconciling spreadsheets, and chasing down missing information. According to property management professionals, manual accounting processes consume 20-30% of a manager’s time.

Increased Risk of Errors and Fraud

Manual systems create blind spots. Unauthorized transactions go unnoticed. Duplicate payments slip through. Expense misclassifications hide the truth about where money is going. These aren’t just accounting problems—they’re governance issues.

Now let’s talk about the solution. When you outsource accounting to professionals using modern systems, everything changes.

With automated accounting platforms, financial data updates in real-time. Your board portal shows current balances, expense summaries, and aging reports without you lifting a finger.

What This Enables:

Professional accounting platforms integrate with asset management systems. This means you can now track which buildings, amenities, or services consume the most resources.

Real Example: Your landscaping costs are higher than budgeted. Instead of just seeing the bottom-line number, you can drill down and see that two specific properties are driving the overage. This insight lets you make targeted improvements—maybe renegotiate contracts for those properties or adjust service levels.

Outsourced accounting professionals use historical data and industry standards to help you build accurate reserve studies. They can model different scenarios and show your board what reserves are actually needed.

The Benefit: No more surprises. Your community understands why reserves are necessary, and special assessments become rare.

Professional accountants know industry regulations. They ensure your association follows accrual-basis accounting (GAAP-compliant), maintain organized documentation, and prepare detailed aging reports for assessments receivable and accounts payable.

The Outcome: Audits go smoothly. Your board has confidence in financial statements. Regulatory compliance is automatic.

Here’s something many managers overlook: poor accounting directly impacts your ability to maintain assets effectively.

Think about it. If you don’t know exactly how much you’re spending on each building’s maintenance, how do you prioritize capital improvements? If you can’t track which reserve funds are allocated to which projects, how do you manage the reserve study? If your books are inaccurate, how do you make reliable long-term plans?

Accurate accounting gives you this information:

1. Maintenance Spending by Asset

You see which buildings require the most maintenance investment. You identify aging infrastructure before it becomes an emergency. You can plan predictive maintenance rather than reactive repairs.

2. Reserve Allocation Effectiveness

You track whether reserve funds allocated to specific projects are sufficient. You identify areas where reserves were underestimated. You improve future forecasting.

3. Performance Metrics for Decision-Making

You can calculate return on investment for different improvements. You identify which amenities or services deliver the best value. You make strategic, data-driven choices rather than gut-feel decisions.

4. Compliance with Reserve Study Requirements

Many states require HOAs to conduct reserve studies every few years. Accurate financial accounting is the foundation of these studies. Without it, your reserve study is just an educated guess.

So what happens when you actually outsource? Here are the tangible advantages:

| Benefit | Impact |

|---|---|

| Cost Savings | Eliminate expensive in-house staff salaries, benefits, and training. Flexible pricing means you pay only for services needed. |

| Time Freed Up | Your team refocuses on community management instead of data entry and reconciliation. |

| Expertise and Compliance | Professional accountants understand industry regulations and GAAP standards. Audits pass smoothly. |

| Real-Time Reporting | Board members access financial data instantly through online portals. Decision-making speeds up. |

| Fraud Prevention | Automated systems detect anomalies. Segregation of duties prevents unauthorized transactions. |

| Scalability | Adding properties to your portfolio becomes easy. Your accounting scales without hiring more staff. |

| Reduced Errors | Automated processes replace manual data entry. Reconciliation errors drop dramatically. |

Moving to outsourced accounting might feel overwhelming, but it doesn’t have to be. Here’s the typical approach:

Step 1: Audit Current Processes

Identify which accounting tasks consume the most time and create the most errors. Document current systems, tools, and workflows.

Step 2: Select the Right Provider

Look for providers who specialize in HOA accounting. They should offer:

Step 3: Establish Clear Communication

Define what reports the board needs, reporting timelines, and escalation procedures. Make sure your provider understands your community’s specific needs.

Step 4: Transition Carefully

Good providers will handle historical data migration, ensuring continuity and accuracy during the switch.

Let’s paint a picture of how your operations transform:

The transition to outsourced accounting is an investment in your HOA’s future. Yes, there’s an upfront effort to establish the relationship and migrate data. But the long-term payoff is enormous: better decisions, happier board members, more confident homeowners, and a team that finally has time to focus on community improvements instead of administrative busywork.

Your HOA’s financial health deserves better than manual spreadsheets and scattered files. Modern accounting outsourcing solutions give you the visibility, accuracy, and efficiency needed to drive real asset performance improvements.

The question isn’t whether you can afford to outsource accounting. It’s whether you can afford not to.

What is HOA accounting and why is it important?

HOA accounting manages a community’s financial records, member dues, expenses, and reserves. Accurate accounting ensures transparency, compliance, and informed decision-making for boards and homeowners.

How does professional HOA accounting help with reserve fund planning?

Accurate accounting provides insights into reserve fund allocation, helps forecast future needs, and prevents underfunding, reducing the likelihood of special assessments.

What are the common challenges of manual HOA accounting?

Manual processes often lead to delayed reporting, data entry errors, fragmented records, and limited visibility into property-level expenses, making decision-making difficult.

How does outsourcing HOA accounting improve financial efficiency?

Outsourcing streamlines tasks like reconciliations, report preparation, and audit readiness, saving time, reducing errors, and freeing staff to focus on community management.

Can outsourcing HOA accounting help boards make better decisions?

Yes. Outsourced services provide real-time financial data and asset-level insights, enabling boards to prioritize maintenance, manage budgets effectively, and optimize reserve allocations.

Why is accurate HOA accounting critical for compliance and audits?

HOAs must follow state regulations and accounting standards. Accurate, organized records simplify audits, ensure accrual-basis compliance, and minimize the risk of penalties.

How can HOA accounting software improve portfolio visibility?

Integrated software centralizes data, tracks spending by property, and generates real-time reports, giving boards clear visibility into the performance of each asset.

What mistakes should HOAs avoid in financial management?

Common errors include late reconciliations, ignoring delinquent dues, poor reserve planning, and relying solely on manual processes, all of which can lead to inefficiencies and audit issues.

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.