Why Most Property Management Companies Struggle with Month-End Close — And How to Fix It

- February 17, 2026

- Tajinder Malhotra

Month-end close is one of the most important tasks for any property management accounting team. It is also one of the most stressful. For many real estate business owners and finance leaders, this process takes too long, creates too many errors, and delays critical business decisions.

If your company manages multiple properties, you already know the pain. Scattered data, manual reconciliations, and inconsistent processes can turn a routine task into a monthly crisis. The good news is that these problems have clear solutions.

This article explains exactly why most property management companies struggle with month-end close. More importantly, it shows you how to fix these issues and build a faster, cleaner financial close process.

Month-end close is the process of finalizing all financial records for a given month. It includes recording revenue, tracking expenses, reconciling bank accounts, and generating financial reports.

For real estate accounting teams, this process involves:

The primary goal is to produce accurate financial data that helps business owners make informed decisions. When done well, month-end close provides a clear picture of your portfolio’s financial health. When done poorly, it creates confusion, delays, and compliance risks.

Most organizations take 5 to 10 working days to complete their month-end close. For property management firms with large portfolios, this timeline often stretches even longer. Here are the main reasons why.

As portfolios grow, financial operations often remain fragmented. Each property or regional office handles accounting independently. This approach may work when you manage a few properties. But as your business scales, decentralization becomes a serious barrier to clean financial closes.

When each property team uses a separate chart of accounts, the close becomes a reconciliation nightmare. Financial roll-ups get delayed, variance tracking becomes inconsistent, and budget-to-actual comparisons lose accuracy. This lack of standardization creates both operational inefficiency and reporting risk.

Inaccurate or inconsistent record-keeping leads to financial discrepancies. When transactions are not documented properly, tracking property-related income and expenses becomes extremely difficult.

A property accountant must spend extra time hunting for missing data instead of analyzing financial performance. This slows down the entire close process and increases the chance of errors in final reports.

Another common issue is an accounting function with predominantly manual processes. Manual tasks include reconciliations, close checklists, high-volume data entry, and journal entries done outside the accounting system.

A month-end close process with many manual tasks will very likely be inefficient. Manual and opaque tasks lead to a loss of time and productivity for staff. The likelihood of mistakes and errors increases without sound structure and documented policies.

There is also a strong correlation between manual processes and accounting staff turnover. Overworked teams often seek positions with better systems and less repetitive work.

Larger organizations collect data from many different sources. This includes your ERP system, spreadsheets, CRM, and invoices. As a result, your finance team must track down missing figures, double-check submitted data, and communicate with multiple departments.

Data discrepancies severely impact the accuracy of financial reporting and decision-making. Resolving these issues requires extensive back-and-forth communication, which further delays the close process.

Managing the finances of multiple properties can be overwhelming. Tracking income and expenses separately for each property requires careful attention. Without proper systems, information gets lost or mixed up.

This challenge grows as your portfolio expands. The accounting workload increases proportionally, but many firms do not scale their systems or staff accordingly.

Bank reconciliation is a critical step in month-end close. It requires comparing the balance in your financial records with your bank statement. Often this process involves double data entry, which creates opportunities for errors and inconsistencies.

If balances do not match, someone must investigate the discrepancy. This can take significant time, especially if records are poorly organized or stored in multiple systems.

Tracking and categorizing various expenses are challenging and time-consuming. Property managers deal with maintenance costs, repairs, vendor payments, and common area maintenance (CAM) charges.

Accurately assigning costs to specific properties or tenants requires meticulous record-keeping and efficient systems. Failure to do so results in incorrect expense allocations, which affects financial analysis and budgeting.

Chasing down other departments to find necessary data adds significant time to your month-end close. Poor communication leads to delays, inaccuracies, and increased frustration.

When a department misunderstands data requirements or fails to respond promptly, it results in missing or incorrect data submissions. This misalignment extends the close process and increases the likelihood of errors.

Inconsistent reporting formats across departments complicate the close process. When different teams submit reports in various formats, consolidating data becomes inefficient.

This inconsistency leads to misunderstandings, errors, and delays as finance teams work to harmonize reports into a unified format.

Real estate accounting faces unique challenges related to lease accounting. Determining whether a lease should be classified as operating or finance requires careful analysis of contractual terms and applicable accounting standards.

Failure to accurately classify leases can result in misstated financial statements and non-compliance with regulations. Lease liabilities and right-of-use assets must be correctly calculated and disclosed to avoid affecting debt covenants and investor confidence.

Now that you understand the problems, let us look at practical solutions. These strategies can help your property accounting services team achieve faster, more accurate closes.

Without a consistent structure, financial roll-ups get delayed and variance tracking becomes inconsistent1. Create a standardized chart of accounts that all properties use. This catalog should organize all business assets, liabilities, equity, income, and expense accounts.

Standardization ensures that transactions are orderly and easy to assess across your entire portfolio.

A structured close calendar shared with property managers ensures everyone follows the same cadence and meets deadlines1. Define clear timelines for each step of the process.

Consider organizing your calendar like this:

| Week | Tasks |

| Week 1 | Reconcile bank accounts, clear unallocated payments, resolve suspense account items |

| Week 2 | Generate owner statements, review for accuracy, process owner draws |

| Week 3 | Final reviews and report generation |

| Week 4 | Communication with stakeholders |

This structure eliminates confusion and keeps everyone accountable.

A property management month-end checklist is a game-changer for any property management company. It provides a clear sequence of tasks that eliminates delays.

Your checklist should include:

When processes are structured, finance teams gain clarity and can close books faster.

Software is the best solution for reconciliation challenges. Many platforms offer accounts payable and receivable solutions that help teams manage money coming in and going out.

Automation eliminates the risk associated with manual data entry errors. Modern tools categorize and log every expense as it happens, giving finance teams a live view of their numbers.

Look for accounting software that integrates with your property management system. This improves collaboration across finance, operations, and leasing departments.

Instead of each property processing its own invoices, consider a centralized AP team that receives, codes, and approves all payables. Benefits include:

This approach streamlines workflows and reduces the chaos of decentralized operations.

Data discrepancies occur when information comes from multiple systems. Establish a single source of truth for all financial data.

This means using one primary system where all transactions are recorded and all reports are generated. When everyone works from the same data, errors decrease and communication improves.

Relying exclusively on paper purchase orders, invoices, and receipts is risky. Paper records get lost, misplaced in wrong files, and can fade over time.

Shift to digital documents stored in a cloud-based system. Not only is it easier to locate digital items, but it is also easier to edit and update them. Digital records also provide better audit trails.

Late or missed rent payments complicate cash flow management. Integrate advanced online payment systems that allow tenants to pay electronically. Set up automated reminders for overdue payments.

This approach maintains steady cash flow and reduces the time your team spends chasing payments.

Standardized and documented process narratives are best practices for all business cycles. These documents provide the overall roadmap and reference for daily operations.

When processes are documented, new team members can onboard faster. Existing team members have clear guidance during busy periods. And auditors can review your procedures easily.

Outsourcing property accounting services to specialized providers can offer significant advantages. Benefits include:

Outsourcing allows property managers to focus on core competencies like tenant relationships, property maintenance, and portfolio growth. Strategic decision-making becomes easier when accounting tasks are handled by professionals.

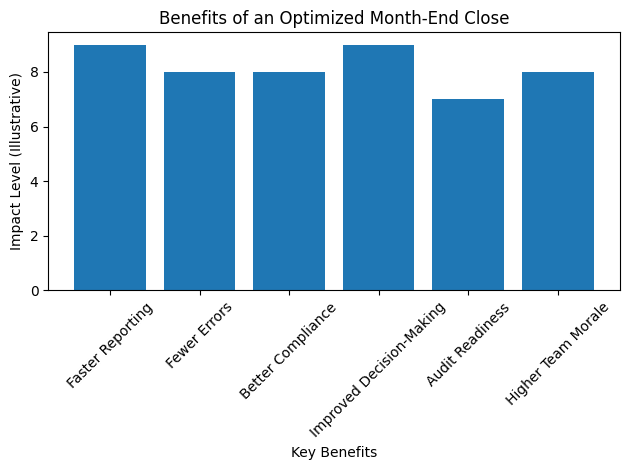

When you fix your month-end close process, your entire organization benefits.

| Benefit | Impact on Your Organization |

|---|---|

| Faster Reporting | Real-time visibility into close progress means no more waiting weeks for financial data. |

| Fewer Errors | Consistent reconciliation and review catch mistakes before they compound. |

| Better Compliance | Standardization ensures you meet regulatory requirements and lender standards. |

| Improved Decision-Making | Timely and reliable data helps your business grow. |

| Audit Readiness | Centralized tracking and documentation reduce audit preparation time. |

| Higher Team Morale | Structured processes reduce stress and overtime during close periods. |

Month-end close does not have to be a monthly crisis. The struggles most property management companies face have clear causes and practical solutions.

Start by identifying your biggest pain points. Is it decentralized accounting? Manual processes? Poor communication? Once you know where the problems are, you can target your improvements effectively.

Remember these essential steps:

The companies that master their month-end close gain a significant competitive advantage. They make better decisions faster. They satisfy investors with timely reports. And they free their teams to focus on growth instead of reconciliation.

Your property management accounting process can become a strength rather than a weakness. It simply requires the right systems, the right processes, and the right partners.

1. What is month-end close in property management?

Month-end close is the process of reconciling accounts, recording accruals, reviewing income and expenses, and generating accurate owner financial reports at the end of each month.

2. How long should month-end close take for a property management company?

High-performing firms typically close within 5–7 business days. Delays beyond 10–15 days usually indicate process inefficiencies or manual bottlenecks.

3. Why is month-end close delayed in property management?

Common causes include manual reconciliations, incomplete documentation, heavy Excel dependency, unclear responsibilities, and delayed bank or trust account reconciliations.

4. What are the risks of a slow month-end close?

A delayed close can lead to inaccurate reporting, owner dissatisfaction, cash flow visibility issues, audit risks, and limited scalability.

5. How can property management companies speed up month-end close?

By standardizing SOPs, automating reconciliations, reducing manual data entry, implementing close calendars, and using integrated accounting and property management software.

6. What reports are included in a property management month-end close?

Typically: income statements, balance sheets, cash flow summaries, bank reconciliations, trust account reports, and owner statements.

7. How does automation improve month-end close efficiency?

Automation reduces manual errors, accelerates reconciliations, improves real-time visibility, and shortens the overall close cycle.

8. What KPIs should be tracked during month-end close?

Key KPIs include days to close, number of post-close adjustments, reconciliation completion rate, reporting accuracy, and on-time owner delivery percentage.

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.