Real Estate Accounting: Everything You Need to Know

- April 19, 2022

- OHI

Real estate involves a large number of financial processes and complications, numerous regulations and laws to follow, multiple transactions for the same property, and many other complexities that need to be organised and managed meticulously.

Given the nature of accounting in the real estate industry, there are exclusive and standardised processes for accounting and bookkeeping that aim to simplify and streamline the process, helping make sense out of such copious amounts of data.

Commercial real estate accounting is conducted on an even larger scale with assistance from software that keeps a good track of all the transactions with pertaining details as well.

Accounting for real estate as the name suggest is a service extremely useful for real estate companies and professionals than it is for others. In a nutshell, if you belong to one of the following categories, you will have a good use for accounting for real estate transactions:

Most people often use the terms “Bookkeeping” and “Accounting” interchangeably. The fact is that while real estate accountants and bookkeepers work towards the same goal, they actually participate in the financial cycle at different stages.

One of the most fundamental differences between the two processes is that bookkeeping is essentially mathematical; it leans more towards recording the transactions mechanically.

On the other hand, accounting is a process where professionals utilise the inputs from bookkeeping to generate meaningful financial insights that help the decision-makers in planning the resources better.

The table below highlights the important differences between real estate accounting and bookkeeping.

| Tasks in Bookkeeping | Tasks in Accounting |

| ~ | ~ |

| Recording and categorising everyday transactions like payments and expenses | Preparing adjusting entries in journals |

| Recording customer invoices and receipt of payments | Analysis of operational costs |

| Generating financial statements periodically/monthly | Review and analysis of financial statements generated |

| Monthly reconciliations of banking statements | Assisting decision-makers with sound financial data |

| Processing employee payrolls | Forecasting the financial status of the business and gauging financial health |

| Preparing company books | Auditing company books |

| Preparing financial documents for year-end assessments | Planning taxes, filing returns, advising the business on tax matters, etc. |

Utilising the services of the best real estate accounting professionals aligns you with many advantages – for both long and short-term goals. Let’s look at some benefits of real estate accounting and reporting.

There are three distinct ways in which accounting for commercial real estate can help improve cash flows:

Professional real estate accounting services help by monitoring and tracking each of these activities in your Accounts Payable ecosystem, ensuring that every task is completed in a timely manner.

When such a well-managed system is established in your real estate firm, the cash flows will begin to improve in the span of a few months.

Good accounting practices in real estate companies sometimes involve the use of accounting software that creates high value in helping improve the income stream of the company.

By keeping a close track of income and expenses, such software is capable of generating personalised recommendations which aim to improve the revenue by suggesting tweaks and flagging problematic processes.

Such software is also equipped with alerts and notifications that can be configured on any device, which let you know when there has been a rent credit or an expense from the accounts of your business. Knowing the movement of every penny in the ecosystem helps you make better financial decisions.

When the taxation season rolls around,real estate accountantsdo overtime, and their billable hours increase – which ultimately translates into more expenses for the business.

Real estate accounting can be, to some extent, automated to prepare the documents and data needed in advance. This data can then be directly shared with the hired accountant to make their work easier and quicker, thus helping the business reduce the outgoing expense.

An initial investment in automation software would sound like a huge deal; however, it is bound to save you more than it’s worth in the long run.

Good accounting practices include taking backups of important documents, processes, data, and information in case of unforeseen losses or mishaps. In the event of a surprise audit, all the necessary data needed would be in place and accessible, helping the auditor to wrap the process up quickly.

An efficient system of accounting – whether manual or automated – involves recording the footprints of all the income and expense items that are claimed and creating backups of such documentary evidence in case an audit is conducted.

Instead of having your entire workforce running around fumbling for papers, a neatly organised deck of records is thus created.

Real estate accounting isn’t merely number crunching. In places where multiple properties are involved for a business to grow, it becomes important to assess how lucrative these properties are and whether a reallocation of resources is needed.

Certain real estate accounting services also provide valuable insights on rental performance, underperforming properties that a business could sell, comparing YoY metrics for various financial parameters, creating a report with historical performances of various properties with a company, etc.

Knowing exactly how much returns each of your properties is generating helps you better adjust your strategies and expand by investing in the more lucrative options.

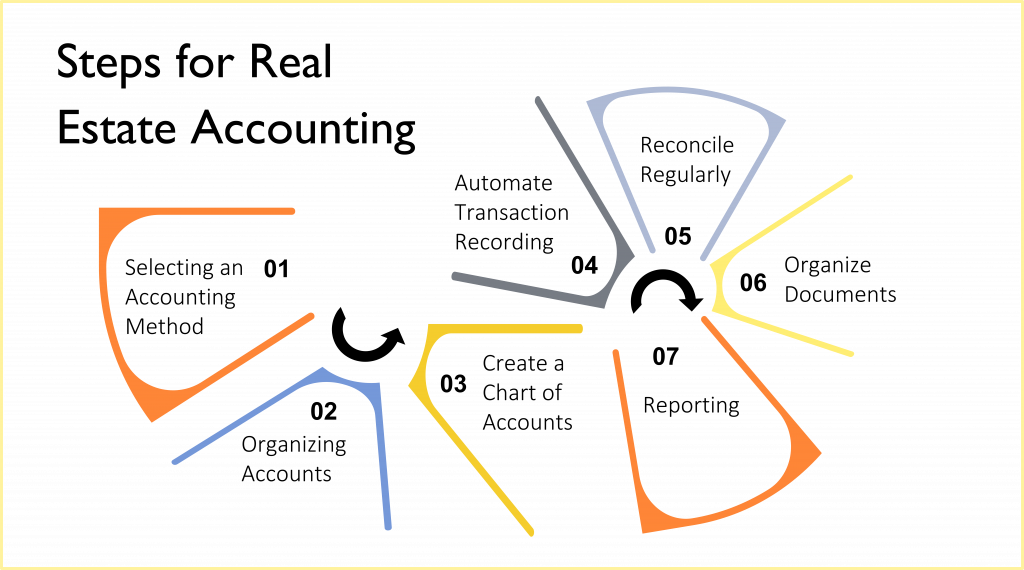

When setting up accounting in real estate companies, it is important to keep these steps in mind to establish a system that is accurate and efficient.

Follow the seven steps mentioned below to get the most out of your real estate accounting.

Before beginning accounting operations at your firm, the first step is always to choose an accounting method. There are two major types of accounting methods:

The next step in real estate accounting is to keep personal and business accounts separate. For this purpose, you can establish a business checking account, which would allow you to tally your income and expenses more efficiently.

Additionally, keeping separate accounts will also help you to:

A chart of accounts is a tool that places all the accounts of your real estate business’s general ledger in one place and records transaction details like income and expenses.

In the real estate business, a chart of accounts is a handy tool that helps you organise items categorically, like transactions based on the type of property, Schedule E, or any way you want.

Real estate is a busy business. You can optimise your workforce utilisation by automating the recording process of transactions as they happen.

Real estate accounting software monitors the transactions happening at your company and automatically categorises each item according to specified rules, filing the entry away into the correct account. The best part is that all of this happens in real-time, always keeping your accounts up to date.

Reconciliation in accounting is the process through which an accountant verifies that your accounting system shows the same balance in accounts as your bank.

In essence, the opening and closing balances in your real estate accounting system should reflect the same numbers as the opening/closing balances in your bank. This will also help you identify the errors or missing transactions in your accounting system.

Before accounting activities can begin at your firm, arrange for proper storage and organisation of all real estate related documents, such as:

The real estate industry deals with a high volume of paperwork, and it is important to keep all of it organised for efficient, accurate accounting.

Reporting in real estate accounting is as important as maintaining good books. Invest in good real estate accounting software with capabilities to generate reports automatically, and deliver insights on any device that the users log in from.

Having this data handy helps to make informed decisions regarding the properties that your company owns.

Growth happens when the foundational practices are efficient and well-informed with sound data. Whether your real estate business is small scale or spans globally, it is important to keep track of the actions and processes happening at your firm so that your business can grow.

Here is a list of six important parameters to track in real estate accounting and reporting.

Earning through commissions is the primary source of income in the real estate industry.

Instead of employing dedicated commission trackers to record these earnings, install a centralised accounting system that covers commission tracking from all arms of your real estate business.

It is important for your real estate accountant to include the costs of maintaining/renewing real estate licensing and continuing skill development and education costs in the yearly documentation.

Tracking these expenses helps understand the returns from these investments.

In order to stay associated with larger communities in the industry (that help send business your way), you may need to pay an association fee – this is counted as an expense. Additionally, depending on how a real estate agent is employed, a brokerage may also be charged.

Tracking these expenses is a good accounting practice.

Office supplies like pens, papers, inks, whiteboard markers, etc., typically go unaccounted for and may mount up to massive pending accounting.

Always track the expenses incurred on office supplies – however minimal or monumental they may be – so that you have visibility of everything.

Merely swiping the company card for entertaining business prospects isn’t going to solve real estate accounting troubles. It is important to properly record and track these expenses so that they can be optimised in the future.

Giving out advertisements, developing a website, marketing campaigns, marketing agency fees, etc., are all counted as marketing expenses.

Accounting in real estate agencies should track these expenses to better measure the returns these activities are generating.

When organising the real estate accounting system at your firm, inculcate these best practices from the get-go to establish a process that is streamlined and efficient.

These points also help discern an experienced real estate accountant from a disorganised, inefficient one.

Conducting a monthly review of your accounts helps you understand how up-to-date your accounting is and whether it tallies with the bank.

When you employ real estate accounting software for this purpose, much of this information would be automated in the backend, and reviews won’t take long.

When working with a professional accountant, though, you can request the submission of a monthly accounts review report by including it in their scope of work. A professional accountant would have it ready and may even proactively alert you about any discrepancies.

Many real estate accounting firms today employ software for accounting activities, making things simpler and eliminating errors and inaccuracies. It is possible to handpick financial parameters from your accounting ecosphere and generate trend reports with them where software handles most of the work.

When employing the services of accountants who handle things manually, reporting may be limited to the more traditional parameters and may take longer to come through.

Regardless, it is important to generate periodic reports of your business accounts to understand the lifecycle of funds at your company.

At the end of the day, you may keep all of what you earn – but it doesn’t have to flow through the same account. Keeping your business account separate from your personal account helps you segregate expenses and also monitor them.

This is especially helpful during the taxation season when it becomes important to separate expenses like groceries and office supplies for accounting reasons.

Use your business account for everything business, and transfer the earnings to your personal account to keep your books straight and accounts organised.

Not all income and expenses at a real estate firm are the same. It is an important practice to create categories for the itemisation of earnings and expenses.

Whether it be rent or income from the sale of a property, whether it be a litigation expense or association fee, it is necessary to assign an identity to each transaction so that it can be organised properly in the accounting system.

When accounting is done using software, after setting up the rules for itemisation initially, the automation functionality handles itemisation from thereon. When manual accounting is involved, a firm practice should be established.

Real estate is a sensitive industry when it comes to adherence to laws, regulations, and rules laid out by the local and national governments.

In accounting, especially, every return filed and document created must adhere to the law and regulations down to the last T. It is advisable to have a professional always tracking the changes in rules and regulations, updating the accountant about it.

When the accounts are managed through software, compliance procedures may already be built into the system. However, you may need to check with the vendor if manual intervention is needed for staying compliant.

Below is a list of the top real estate accounting software of 2022. If your business is considering the move, consider these options.

Appfolio property manager is a popular choice among many real estate agents as it is a cloud-based service. It understands that the agents are always on the go and may need to access portfolios anytime, anywhere. It is a customer-centric organization, and their property management software ranks number one on the list for its ease of use and excellent customer support.

Voyager property management software centralizes various operations such as lease management, maintenance management, property risk damage insurance, tenant screening, and revenue management. It also enables real estate agents to efficiently market their portfolios. It further provides real-time solutions to the agents and property managers, making it one of the most popular real estate software.

MRI real estate software is a flexible and comprehensive solution for property managers. It allows real estate agents to manage different properties, such as residential, commercial, retail, affordable housing, as well as public housing. This software has features such as facilities management, lease management, and back-office automation.

RealPage property management software has been designed to integrate analytics into the real estate business to yield profitable insights. This software offers many unique features such as renters insurance, which not only protects the renters but also the managers against property damage risks. It also allows property managers to receive and make online payments.

Buildium property management software is a great tool for real estate agents as it not only allows them to manage their listings but also helps with accounting, operations, and leasing. It helps the agents keep track of the expenses while allowing them to accept and make payments. This software can be accessed from various devices such as iPads, mobiles, as well as desktops and laptops.

Accounting is a very labour-intensive task; errors can creep in no matter how careful one is.

The good news is that by avoiding these common mistakes in the process, errors and inaccuracies can be minimised to a level that can be managed easily. In a nutshell, here are the common real estate accounting practices you must avoid.

Owing to the following factors, accounting in the real estate industry has become a little complex:

However, even with all of these complications, all of these complications can be easily dealt with using good real estate accounting software.

You can easily outsource accounting for your real estate business in five simple steps:

P&L stands for Profit and Loss. A P&L statement of a real estate business is a record of the financial performance of all the properties enlisted with a business for a particular period of time. This statement is a break-up of the income and expenses of a property and its operating profit.

Real estate accounting is not a complicated job to get right; the trick is to keep the process sorted from the get-go in order to keep things seamless along the way. Small to medium scale firms can deploy basic software as an in-house solution; however, it may create hindrances when scaling up. For large scale firms, it is best to outsource real estate accounting to professionals.

The deciding factor in choosing the right real estate accountant is to understand the best practices of the niche and check whether your prospects follow these. Additionally, you can also gauge this based on their proficiency in using software for accounting.

All in all, avoiding mistakes like mixing personal and business accounts and not doing timely reviews should ensure that your accounts remain straight for the accountant to do the needful.

OHI is a fifteen-year-old real estate services company working with 50+ commercial and residential real estate developers, funds and property management companies across USA. Our deep expertise in real estate accounting, financial analysis, lease administration and asset management has helped clients cut associated costs by 40-50%. We now provide these services to a portfolio of 75000 units across clients.

We invite you to experience finance and accounting outsourcing through us.

Low Cost Property Accounting Services for Real Estate Companies: AP | AR | Reconciliations | Month End Closing | Financials | Year End Accounting | Reporting – VIEW MORE

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.